MercadoLibre (NASDAQ:MELI) dropped in pre-market trading as its fourth-quarter profit took a hit due to tax expenses. The Argentine company that operates online marketplaces reported a Q4 profit of $165 million, below analysts’ estimates of $356 million. Its profit was hit by two one-off tax provisions in Brazil totaling $351 million. These tax provisions were linked to tax obligations in a prior period, and MercadoLibre does not expect these provisions to have a material cash impact going forward.

The firm reported earnings of $3.25 per diluted share in the fourth quarter, staying flat year-over-year, less than half of analysts’ estimates of $7.09 per share. MELI posted Q4 revenues of $4.26 billion, a rise of 42% year-over-year, beating Street estimates of $4.14 billion.

MercadoLibre’s total payment volume increased by 57.2% year-over-year to $56.5 billion, while gross merchandise volume (GMV) was $13.5 billion in Q4, an increase of 39.9% year-over-year. The company defines GMV as the total U.S. dollar value of transactions on the Mercado Libre Marketplace, excluding classified transactions.

Is MELI a Buy or Sell?

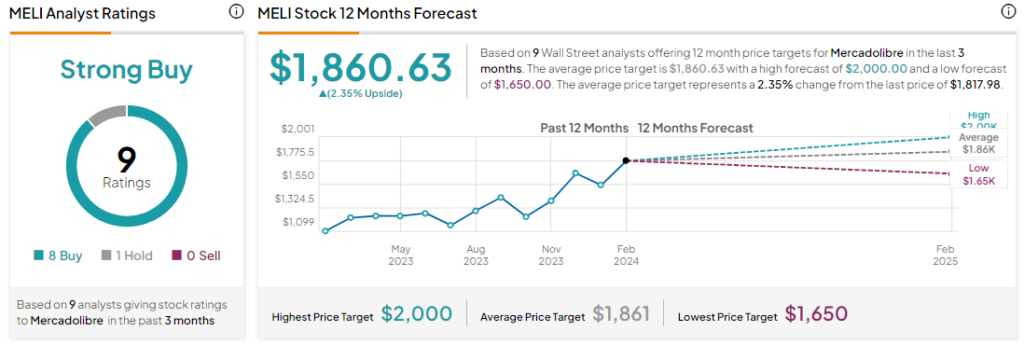

Analysts remain bullish about MELI stock with a Strong Buy consensus rating based on eight Buys and one Hold. Over the past year, MELI stock has surged by 60%, and the average MELI price target of $1,860.63 implies an upside potential of 2.4% at current levels. However, it’s worth noting that estimates will likely change following today’s earnings report.

Questions or Comments about the article? Write to editor@tipranks.com