Medtronic Plc (MDT) announced it has entered into a tender offer to buy all of the outstanding stock of spine surgery tech-maker Medicrea to strengthen its spinal surgery business.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Medtronic is offering to buy the outstanding shares of the spinal surgery tech-maker at €7 per share representing a 22% premium to yesterday’s closing price.

Medicrea’s largest shareholders, including founder and CEO Denys Sournac as well as certain other key managers, will tender their shares in the offer. As a result, Medtronic has commitments to buy 44.4% of Medicrea’s current outstanding share capital.

The acquisition, which is expected to close by the end of 2020, will be immaterial to Medtronic’s adjusted earnings per share in the first two fiscal years before turning accretive in fiscal year 2023. In addition, the deal meets Medtronic’s long-term financial metrics for acquisitions, the company said.

“Combining Medtronic’s portfolio of spine implants, robotics, navigation, and 3D imaging technology with Medicrea’s capabilities and solutions in data analytics, artificial intelligence and personalized implants, would enhance Medtronic’s fully-integrated procedural solution for surgical planning and delivery,” said Jacob Paul, senior VP at Medtronic’s Cranial & Spinal Technologies division. “Medtronic will become the first company to be able to offer an integrated solution including artificial intelligence driven surgical planning, personalized spinal implants and robotic assisted surgical delivery, which will significantly benefit our customers and their patients.”

Shares in Medtronic rose 2.3% to $96.48 in morning trading on Wednesday, trimming their year-to-date decline to 15%.

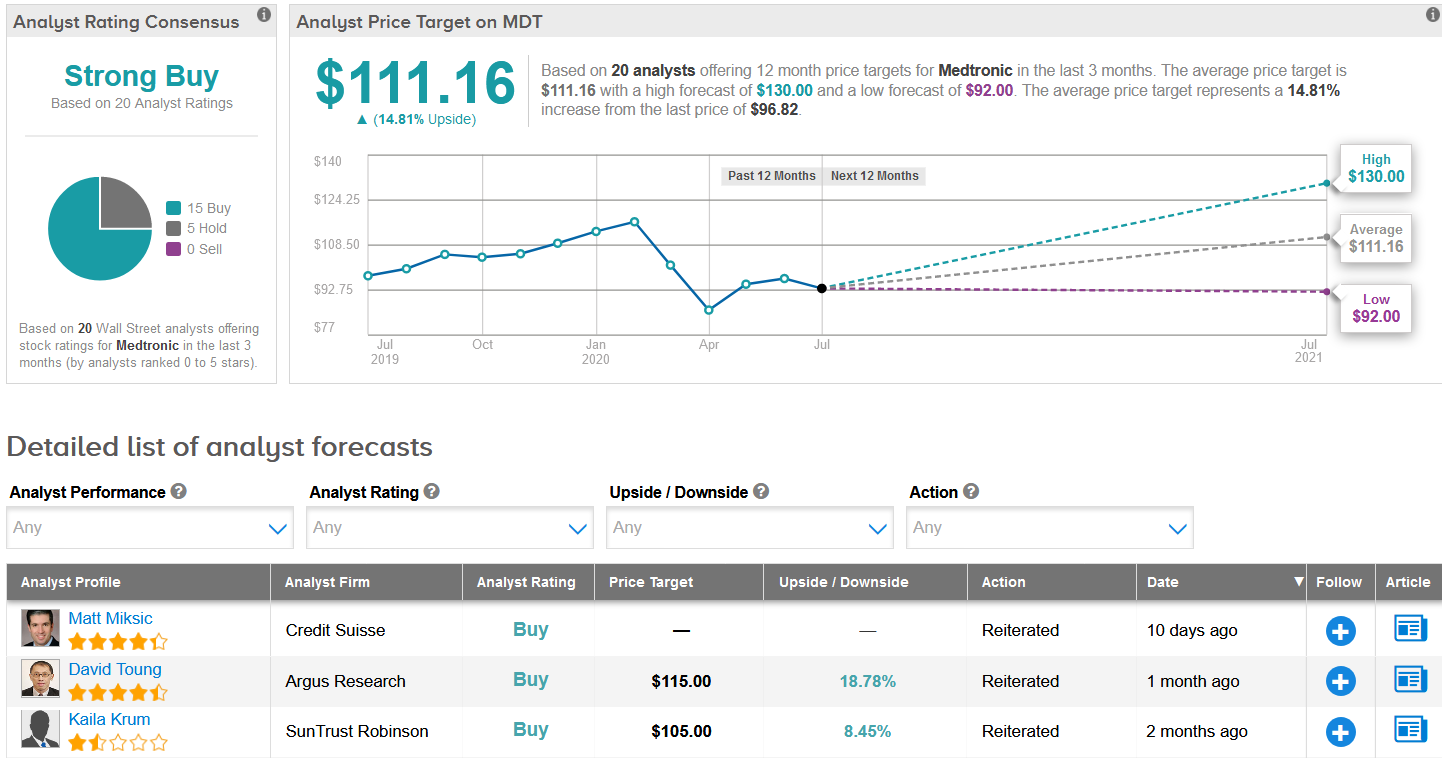

Argus Research analyst David Toung recently maintained a Buy rating on the stock with a $115 price target (19% upside potential), saying that the company has strong growth opportunities from both its current and soon-to-be-launched products.

Toung cut his FY21 EPS view on the stock to $4.05 from $6.05 to reflect the reduced elective procedural volume during COVID-19. At the same time though, Medtronic is also seeing gradual sales improvement as hospitals in parts of the U.S. have resumed elective procedures, the analyst added.

The rest of the Street is also bullish on the stock. The Strong Buy analyst consensus breaks down into 15 Buy ratings versus 5 Hold ratings. The $111.16 average analyst price target implies 15% upside potential in the shares over the coming year. (See Medtronic stock analysis on TipRanks).

Related News:

Boston Scientific Mulls Billion-Dollar Snake Venom Sale- Report

Abbott Labs, Edwards Lifesciences Settle Heart Device Patent Disputes

Akebia Initiates Vadadustat Study In Covid-19 Patients