Shares of MongoDB (MDB) surged in after-hours trading after the software company reported earnings for its third quarter of Fiscal Year 2025. Earnings per share came in at $1.16, which smashed analysts’ consensus estimate of $0.68 per share. In addition, sales increased by 22% year-over-year, with revenue hitting $529.4 million. This also beat analysts’ expectations of $497.72 million.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

MongoDB’s third-quarter results were driven by a strong Enterprise Advanced performance and a 26% growth in Atlas revenue. In addition, the company continues to win new business, which, according to President and Chief Executive Officer Dev Ittycheria, highlights the strength of the firm’s developer data platform in handling diverse, mission-critical use cases.

2025 Outlook

The guidance also thrilled investors. In fact, management now expects revenue and adjusted earnings per share for Q4 2025 to be in the ranges of $515 million to $519 million and $0.62 to $0.65, respectively. For reference, analysts were expecting $506.1 million in revenue, along with an adjusted EPS of $0.56.

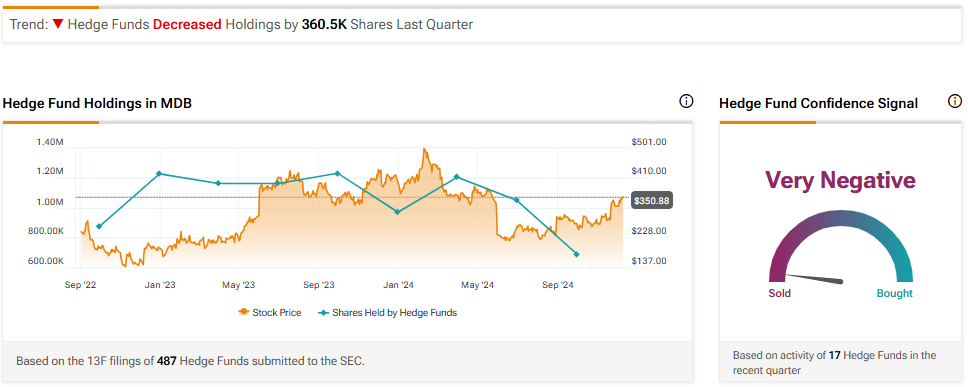

Today’s results and subsequent surge come after money managers spent most of the last quarter selling the stock. In fact, hedge funds decreased their holdings in MDB stock by 360,500 shares in the past quarter. As a result, they have a very negative confidence signal, as indicated by the graphic below. It will be interesting to see if hedge funds decide to jump back in going forward.

Is MDB Stock a Buy?

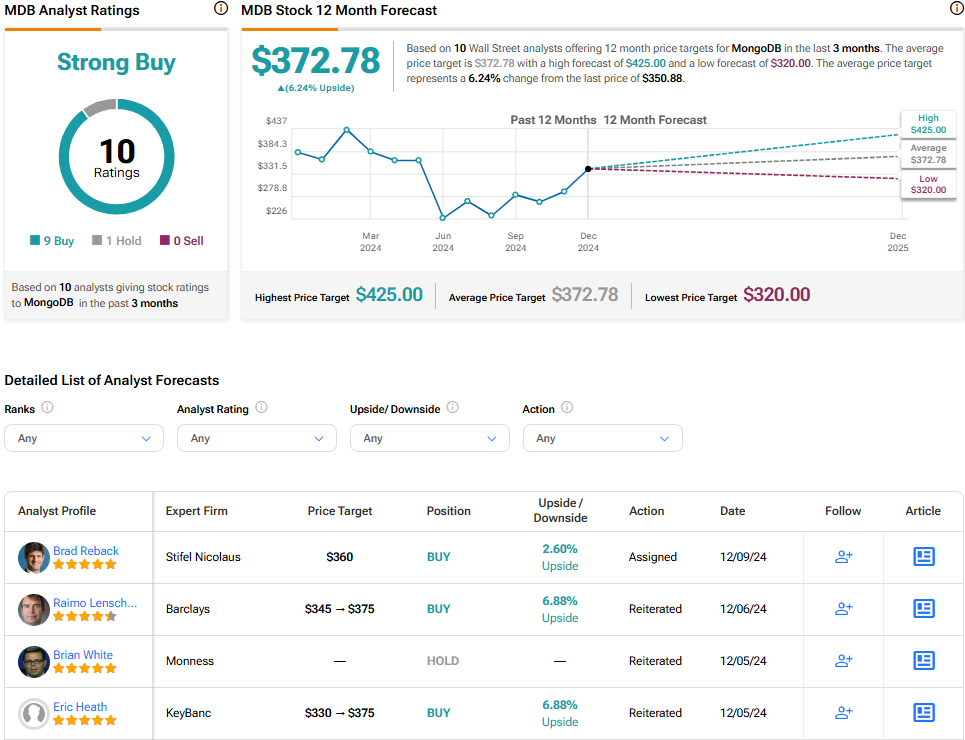

Turning to Wall Street, analysts have a Strong Buy consensus rating on MDB stock based on nine Buys, one Hold, and zero Sells assigned in the past three months. Furthermore, the average MDB price target is $372.78 per share, which implies an upside potential of 6.24% after a 14% year-to-date decline. However, it’s worth noting that estimates will likely change following today’s earnings report.