While it’s not exactly a great time to be a mall-facing store these days, for Abercrombie & Fitch (NYSE:ANF), a plan to give it a bit of new life excited investors. A new partnership arrangement with McLaren Formula One Racing sent shares down over 3% in Wednesday afternoon’s trading.

The partnership arrangement called for the development of new clothing with licensed McLaren graphics, as well as new “content creation” and “social media collaborations and events.” The deal reportedly goes back to 2023, when Abercrombie brought out a line of McLaren t-shirts and similar items that exploded in popularity on TikTok. Indeed, Gen Z increasingly finds Abercrombie clothing more palatable after being previously declared one of the most hated retailers in America and being the subject of an unpleasant Netflix (NASDAQ:NFLX) documentary called “White Hot.”

One Serious Turnaround

Now, how exactly does a reviled brand in a dying environment like the modern American shopping mall not only recover but also post a 285% gain in its stock price throughout 2023? A wide-scale rebranding effort, for starters, complete with redesigns of its product mix and its overall marketing efforts after struggling to grow behind the high-school marketplace it so avidly courted in the 1990s and early 2000s. The gains were phenomenal, as Abercrombie’s explosive rise was even greater than that seen with Nvidia (NASDAQ:NVDA) stock, which could only muster a 239% gain at the same time.

Is Abercrombie & Fitch a Good Buy Right Now?

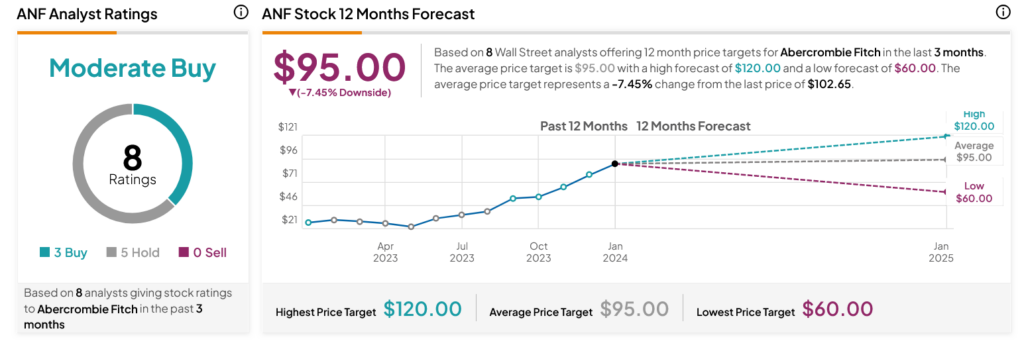

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ANF stock based on three Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 254.43% rally in its share price over the past year, the average ANF price target of $95 per share implies 7.45% downside risk.