McDonald’s (MCD) has filed a lawsuit against the four largest beef producers in the U.S., according to a Financial Times report. The fast-food chain has accused them of inflating the price of meat it purchased.

Details of MCD’s Lawsuit Against the Beef Producers

The lawsuit, which was filed in a federal court in New York, alleges that major meat processing companies, including Cargill, JBS (JBSAY), National Beef, and Tyson Foods (TSN), “engaged in a contract, combination, or conspiracy in restraint of trade or commerce,” in violation of antitrust laws. The fast-food giant has claimed that this conspiracy has kept beef prices “artificially higher than they would have been” in a competitive market.

Elaborating further, MCD stated that one method used by the beef producers was suppressing the prices they paid for cattle ready for slaughter, which allowed them to maintain high margins on the beef they sold. The lawsuit also argued that the companies “exploited their pivotal role” in the beef supply chain to manipulate both cattle prices and beef prices. In addition, MCD has claimed that these meatpackers have been engaging in this practice since 2015.

U.S. Meatpacking Industry Is Under Rising Scrutiny

According to the report, citing data from the U.S. Department of Agriculture, slaughterhouses in the U.S. processed 32.8 million head of cattle in 2023, resulting in 27 billion pounds of beef. This lawsuit follows a series of proposed class-action cases filed by cattle ranchers and beef customers against the major meatpacking companies, indicating increasing scrutiny of the industry’s pricing practices.

Is McDonald’s Stock a Buy or Sell?

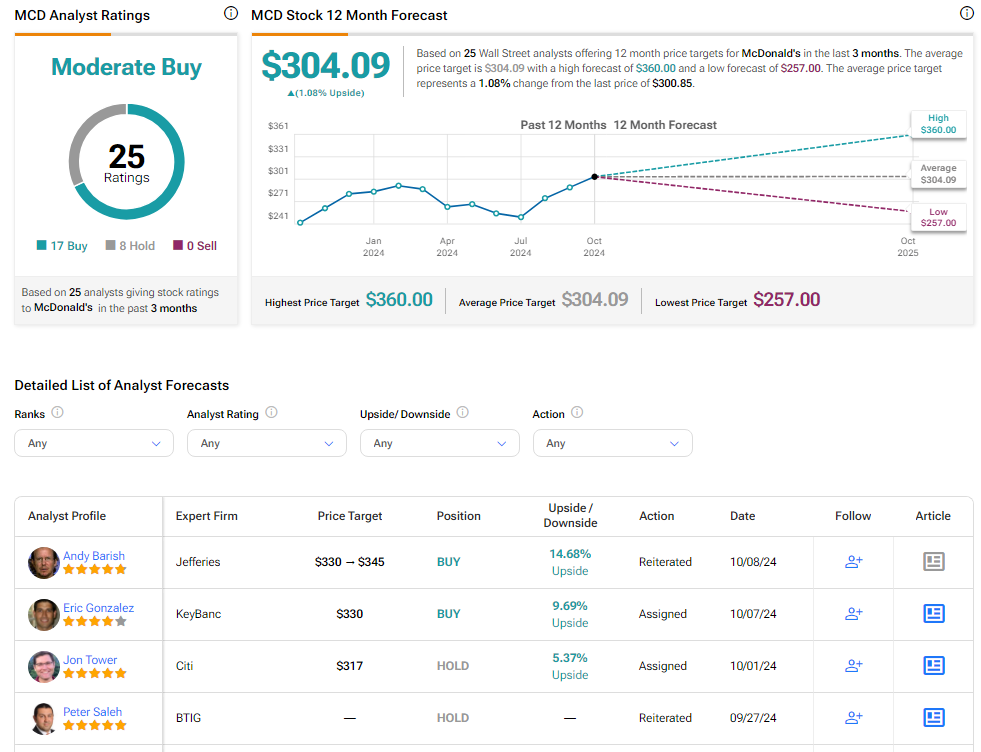

Analysts remain cautiously optimistic about MCD stock, with a Moderate Buy consensus rating based on 17 Buys and eight Holds. Over the past year, MCD stock has increased by more than 20%, and the average MCD price target of $304.09 implies an upside potential of 1.1% from current levels.