Give fast-food chain McDonald’s (NYSE:MCD) some credit; it knows what side of the Big Mac bun the special sauce is applied to. And it’s putting a lot of extra weight behind its franchisees, offering a new digital marketing fund to help them improve their access to mobile business. Investors, however, were a bit skeptical, and shares were down fractionally in Thursday afternoon’s trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

McDonald’s has been moving to expand its online operations for some time now, with a particular focus on its mobile app. And now, it’s putting its money where its ambition is by offering franchisees access to the aforementioned digital marketing fund, which will reportedly move to update the company’s marketing, and give it more of an advantage in the market.

The fund will invest “hundreds of millions of dollars” over the next few years and include some further modifications. One particularly anticipated change will be the ability to place orders online, not solely through a mobile app.

More to Order, Too

Changing a marketing strategy can be a good play, but it certainly doesn’t hurt to have something new to promote. And McDonald’s is working on that end, too. Not long ago, McDonald’s announced that it would step up its portion sizes and offer bigger burger options. All fine and well, but McDonald’s is taking that a step further by announcing that still larger options would be coming out as well. While customers are feeling the impact of inflation and shrinkflation alike, McDonald’s move toward bigger might be just what the company needs to draw interest, which a marketing program can capitalize on in turn.

What Is the Future of McDonald’s Stock?

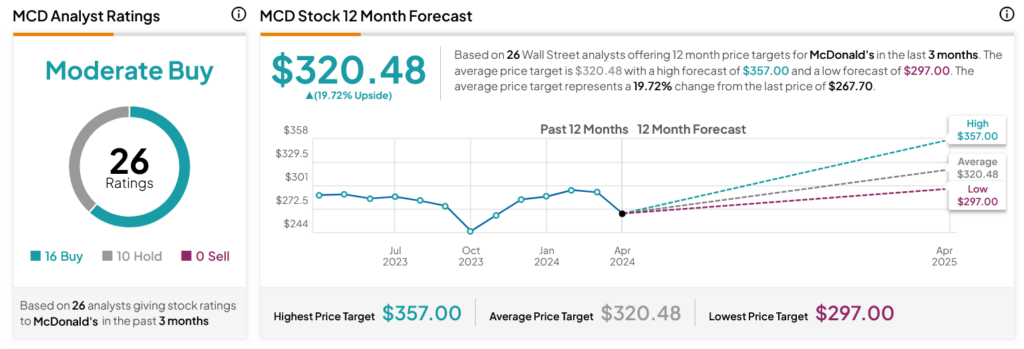

Turning to Wall Street, analysts have a Moderate Buy consensus rating on MCD stock based on 16 Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 7.76% loss in its share price over the past year, the average MCD price target of $320.48 per share implies 19.72% upside potential.