Mobileye Global (NASDAQ:MBLY) announced disappointing Q1 results. The company swung to a loss in Q1 with an adjusted loss of $0.07 per share, compared to earnings of $0.14 per share in the same period last year. Analysts were expecting the company to report a loss of $0.06 per share.

The company that provides driver-assistance technologies generated revenues of $239 million in Q1, which was a steep decline of 48% year-over-year but surpassed consensus estimates of $231.05 million. Mobileye’s revenues declined in Q1 as its customers utilized the excess inventory held by them and hence did not place any new orders.

Looking forward, MBLY has forecasted FY24 revenues in the range of $1.83 billion to $1.96 billion with adjusted operating income likely to be between $270 million and $360 million.

What Is the Forecast for MBLY?

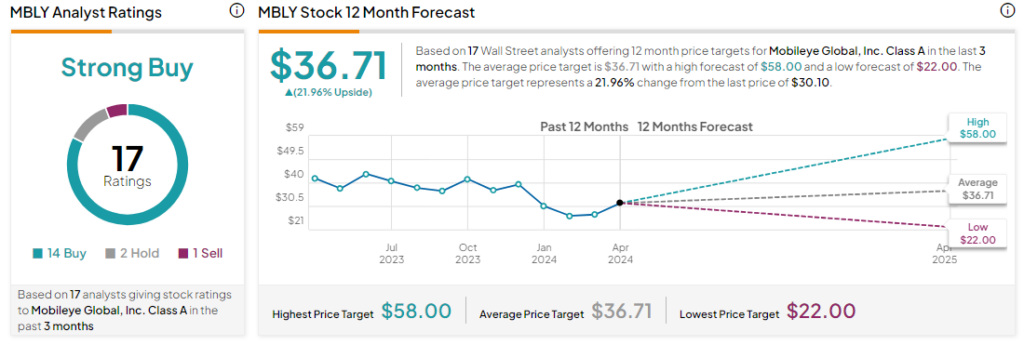

Analysts are bullish about MBLY stock, with a Strong Buy consensus rating based on 14 Buys, two Holds, and one Sell. Year-to-date, MBLY has declined by more than 30%, and the average MBLY price target of $36.71 implies an upside potential of 21.9% from current levels. These analyst ratings are likely to change following MBLY’s Q1 results today.