Matterport, Inc. (NASDAQ: MTTR), the spatial data company, has reported a larger-than-expected loss for the fourth quarter of 2021 and disappointing guidance.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Following the results, shares of the company lost more than 14% in pre-market trading after closing 5.6% lower on Wednesday.

Results in Detail

Matterport incurred an adjusted loss of $0.10 per share, higher than the Street’s loss estimate of $0.09 per share. The company had reported a loss of $0.01 per share in the same quarter last year.

Meanwhile, total revenues generated during the quarter grew 15% year-over-year and stood at $27.1 million, topping the consensus estimate of $25.13 million. Markedly, total subscribers jumped 98% to 503,000 from the prior-year quarter.

Segment-wise, subscription revenue was $16.5 million, up 32% year-over-year, while services revenue grew 68% to $3.7 million. Meanwhile, license revenues came in at $284,000, down 43%, while product revenue declined 21% and stood at $6.6 million.

For 2021, Matterport has posted a loss of $0.23 per share, compared to the loss of $0.07 per share recorded last year. Revenues stood at $111.2 million, up 29.5% year-over-year.

CEO’s Comments

The CEO of Matterport, RJ Pittman, said, “Relentless innovation is the norm at Matterport, and with new products like Matterport Axis and Matterport for Android, we are racing to bring precision 3D capture and digital twins to everyone in the built world. Looking forward, the physical world is going digital. Every industry on every continent is embracing digitization, and I am more confident than ever about the company’s outlook for 2022 and the decade ahead.”

Guidance

For the first quarter of 2022, the company anticipates an adjusted loss of $0.13-$0.15 per share against the consensus loss estimate of $0.04 per share. Further, it foresees revenue between $25.5 million and $27.5 million, compared to consensus estimates of $31.85 million.

For 2022, the adjusted loss is anticipated in the range of $0.47 to $0.52 per share versus analysts’ loss expectations of $0.23 per share. Matterport expects to post revenue in the range of $125 million and $135 million against the consensus estimate of $160.39 million.

Wall Street’s Take

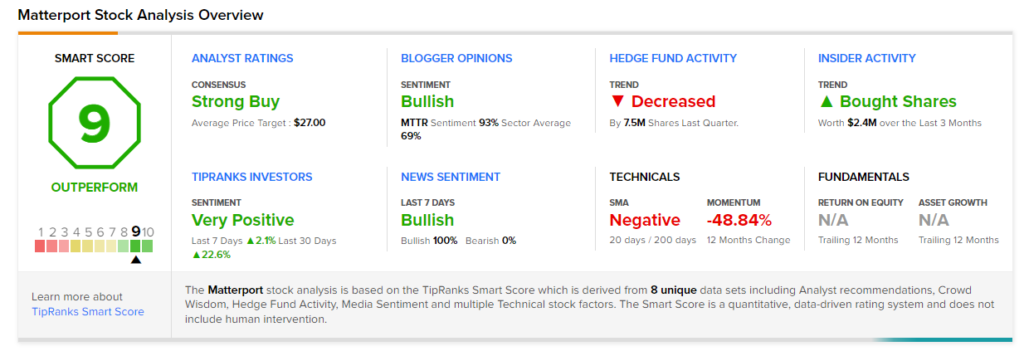

Consensus among analysts is a Strong Buy based on 4 unanimous Buys. The average Matterport price target of $27 implies 240.91% upside potential from current levels. However, shares have lost 26.4% over the past year.

Smart Score

Matterport scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Virgin Galactic Pops 32% After Offering Future Spaceflight Reservation

ContextLogic Introduces ‘Wish Clips’ Feature; Shares Jump Over 18%

Toast Posts Greater-than-Expected Q4 Loss; Shares Decline Over 15%