Mastercard (MA) delivered a robust performance in Q2 of 2024, reflecting its sustained growth trajectory in the payments processing industry. Specifically, the payments processing giant posted notable revenue growth across its core and emerging markets, bolstered by solid consumer spending and expansions into value-added services. In the meantime, due to Mastercard’s scalable business model, its margins continue to rise, which, along with continued share buybacks, led to another period of explosive earnings per share (EPS) growth. With Mastercard’s top and bottom line growth set to persist, I am bullish on the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

What Has Driven Mastercard’s Revenue Growth Lately?

Mastercard’s revenue growth continues to thrive, driven by resilient consumer spending. This sustained trend strengthens my confidence in the stock, particularly as consumer spending remains robust despite mixed macroeconomic conditions.

In particular, Mastercard’s net revenues hit $7.0 billion in Q2, marking an 11% growth compared to the second quarter of last year and a new quarterly record. Michael Miebach, Mastercard’s CEO, attributed this success to Mastercard’s dual focus on expanding its core payments network and increasing demand for value-added services.

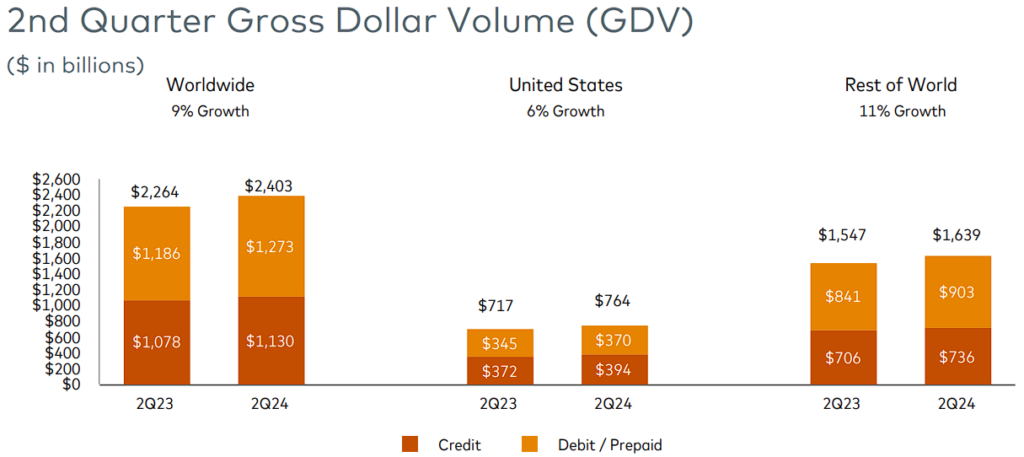

To clarify, Mastercard’s payment network alone saw a 7% rise in revenue, powered by a 9% rise in gross dollar volume (GDV), reaching $2.4 trillion, while cross-border volumes surged by 17%. The latter reflects the ongoing global travel and tourism recovery, which has remained vibrant for numerous quarters even after the initial post-pandemic revenge-travel boom.

The other critical element supporting Mastercard’s revenue growth was its value-added services, which rose by an impressive 19% on a currency-neutral basis. This segment includes consulting, data analytics, fraud prevention, and identity authentication services, which are becoming increasingly important to businesses in today’s digital economy. The high demand for these services, along with Mastercard’s strong payment systems, created a ‘flywheel effect,’ where each success helped drive even more growth for the company.

MA Earnings Surge due to Continued Margin Expansion

In Mastercard’s Q2 report, its earnings actually outpaced revenue growth, which is pretty impressive and further bolstered my bullish stance on the stock. A big part of that comes down to Mastercard’s enduring margin expansion, largely thanks to its frictionless, high-margin business model.

What’s interesting about Mastercard is how its royalty-like structure works. Essentially, it allows it to handle more payments and grow revenues without taking on much in the way of extra costs. This dynamic has been a key driver behind their ever-expanding margins—something we’ve seen consistently since their IPO.

To give a clearer picture, Mastercard’s adjusted operating margin climbed to 59.4%, which, when blended with the underlying rise in revenues, resulted in adjusted EPS reaching $3.59. This marked a tremendous growth of 24% compared to last year and, similarly to revenues, a new quarterly record.

It’s quite shocking to witness Mastercard sustaining such vigorous growth, even after decades of industry dominance. Despite benefiting from significant trends lately—such as the pandemic-driven surge in e-commerce spending and the post-pandemic spike in “revenge travel,” both of which significantly boosted Mastercard’s transaction volumes, revenues, and earnings—the company’s growth figures continue to defy gravity with their upward trajectory.

Outlook and Valuation Mix Support Upside Potential

Mastercard’s outlook for the remainder of 2024 remains optimistic, and when coupled with what appears to be a fair valuation, it indicates potential for further upside in the stock. To go deeper into Mastercard’s growth outlook, it’s not just the momentum driven by solid consumer spending that fuels the company’s growth. Mastercard is also making significant progress in expanding its footprint in high-growth markets, a key factor that is expected to continue driving its long-term growth.

Namely, Mr. Miebach emphasized his team’s dedication to increasing the company’s presence in regions where cash remains the main form of payment, such as Africa and Latin America. For instance, Mastercard has been aggressively expanding its acceptance footprint in Africa, tripling the number of acceptance locations over the last five years and forging new partnerships with major banks in Ethiopia and Kenya.

Considering these factors and Mastercard’s strong performance in the first half of the year, Wall Street anticipates an 18.6% increase in the company’s adjusted EPS for Fiscal 2024 to hit a record $14.32. This implies Mastercard shares are now trading at a P/E ratio of 33.3.

While this may seem like a rich multiple, it’s essential to factor in Mastercard’s extraordinary ability to consistently post double-digit revenue growth, its ongoing margin expansion, and its dominant position in an industry that benefits from a natural tailwind (i.e., the global shift towards a cashless society). In light of this, I believe Mastercard’s valuation is fair and can support further upside from its current levels.

Is MA Stock a Buy, According to Analysts?

Wall Street’s view on the stock also appears quite bullish, with Mastercard boasting a “Strong Buy” consensus rating based on 22 Buys and four Hold recommendations assigned in the past three months. At $526.95, the average MA stock price target implies 10.68% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell MA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Sanjay Sakhrani from KBW, with an average return of 28.60% per rating and a 95% success rate.

Key Takeaway

To sum up, Mastercard’s most recent results again highlighted its sustained growth across core markets, driven by solid consumer spending and rising demand for value-added services. The company’s scalable, high-margin business model and continued global expansion are poised to keep fueling its top-line and bottom-line growth—a trend that seems poised to endure moving forward.

Simultaneously, with the stock’s valuation matching Wall Street’s optimistic earnings growth expectations, I believe that Mastercard remains well-positioned for further upside, bolstering my bullish view on its investment case.