Mastercard (MA) is to become the exclusive card network for Gemini’s cryptocurrency rewards credit card. The cryptocurrency platform has selected the payment giant, along with WebBank, to offer several innovative features as part of the offering.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Gemini Credit Card, powered by Mastercard, will offer an easy way of acquiring Bitcoin and other cryptocurrencies. In addition, holders stand to earn up to 3% back on purchases involving Bitcoin and more than 30 other cryptocurrencies that Gemini supports.

Gemini is in the process of building a crypto rewards platform that will ensure that crypto rewards are delivered in real-time into cardholders’ accounts. Instead of waiting for a month, as is the case with most credit cards, Gemini cardholders will receive their rewards as soon as a transaction occurs.

The crypto platform is also promising zero annual fees combined with 24/7 live customer support. The sleek metal credit card will be available in black, silver, and rose gold. According to Gemini CEO Tyler Winklevoss, the Gemini Credit Card will offer consumers an easy way of earning crypto rewards.

Winklevoss stated, “Mastercard continues to evolve and meet both industry and consumer demands and commit to the crypto space. We’re excited to partner with them on our first real-time crypto rewards card, further helping to bring crypto mainstream.”

Mastercard shares have rallied 8.92% year-to-date after a 19.5% pop in 2020. (See Mastercard stock analysis on TipRanks).

JPMorgan analyst Tien-Tsin Huang believes Mastercard is benefiting from the ongoing transition into card-based and electronic payments.

“Mastercard’s business is highly defensible and characterized by recurring revenues, high incremental margins, low capital expenditures, and high free cash flow. While COVID-19 will significantly impact near-term growth, we believe underlying secular growth remains strong and could be strengthened in a recovery,” Huang said.

The analyst has reiterated a Buy rating on Mastercard and increased his price target to $387 from $342. This implies approximately 2% downside potential to current levels.

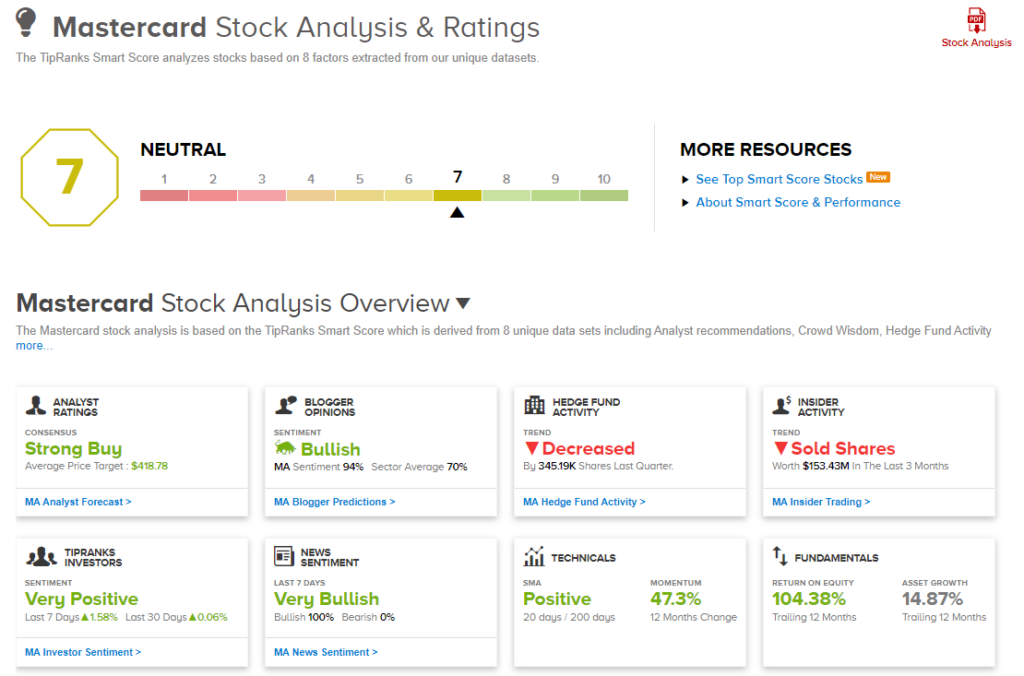

Consensus among Wall Street analysts is a Strong Buy based on 9 Buys and 1 Hold recommendation. The average analyst price target of $418.78 implies 6% upside potential to current levels.

Mastercard scores a 7 out of 10 on the TipRanks’ Smart Score rating system suggesting that its performance is likely to align with market expectations.

Related News:

JPMorgan Partners With DBS and Temasek To Develop Blockchain-Based Payment Platform

Amazon Expands In-Garage Grocery Delivery Service Nationwide

Ford Builds Global Battery Center In Michigan

What is Cryptocurrency