Shares of payment processing company Mastercard (NYSE:MA) fell in trading after a bleak forecast. The company expects revenues to grow in the low double digits year-over-year in the fourth quarter. Mastercard reported adjusted earnings of $3.39 per share in the third quarter, up by 24% year-over-year on a currency-neutral basis, which beat analysts’ consensus estimate of $3.21 per share.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The company’s Q3 net revenues increased by 11% year-over-year to $6.5 billion, in line with analysts’ expectations.

Is MA a Good Stock to Buy Now?

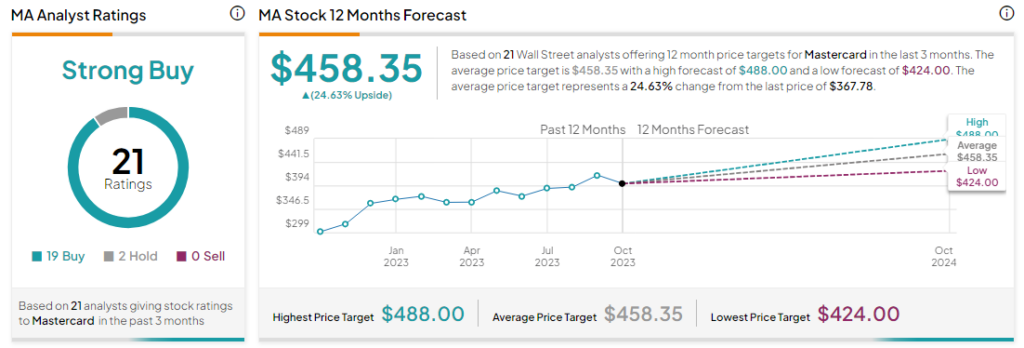

Analysts are bullish about MA stock, with a Strong Buy consensus rating based on 19 Buys and two Holds. The average MA price target of $458.35 implies an upside potential of 24.6% from current levels.