Mastercard (MA) has revealed that it has acquired Arcus FI, a payments-as-a-service platform. Following the news, shares of the global payments & technology company gained 3.4% to close at $340 on Wednesday.

Through this acquisition, Mastercard will get support for the delivery of bill pay solutions and other real-time payment applications across Latin America.

Benefits of the Acquisition

Some of the large billers, retailers, FinTechs and traditional financial institutions in the U.S. and Mexico, along with Latin America, leverage Arcus’ bill pay and cash-in, cash-out services. Notably, its flagship solution, the Arcus Pay Network, has direct access to retailers and billers in Mexico.

The adoption of digital payment solutions has been accelerated in Latin America by Arcus with fast and easy access to deposits, withdrawals and payment services. (See Mastercard stock charts on TipRanks)

Therefore, Arcus’ technology, network and customer relationships will leverage Mastercard Bill Pay in Latin America and deliver a broader set of financial services.

Mastercard Bill Pay allows consumers to view, manage and pay their household and other personal bills from within their preferred financial service provider’s app — securely, conveniently and with full control, the company said in a release. Notably, it works with banks and credit unions and a network of 135,000 billers in the U.S. as Mastercard Bill Pay Exchange.

Official Comments

The Division President for Mexico and Central America at Mastercard, Laura Cruz, said, “With the addition of the Arcus team, we will enhance existing payment experiences and create new opportunities to address every day needs by connecting more people to the digital economy.”

Wall Street’s Take

On November 15, Morgan Stanley analyst James Faucette reiterated a Buy rating and a price target of $448 (31.76% upside potential) on the stock.

Faucette commented, “We continue to expect that international tourism will be a key positive stock catalyst and upside driver for the card networks, especially as countries reopen borders, vaccine progress continues, Delta-variant concerns ease, and consumer demand to travel remains robust. MA expects to deliver low twenties EPS growth, and while the company has generally sustained a ~54-57% operating margin, it stated a floor of 50% to create optionality to increase investments when opportunities arise. The longer-term outlook is in-line with previous market expectations and calls for low-teens to mid-teens revenue expansion.”

Consensus among analysts is a Strong Buy based on 11 unanimous Buys. The average Mastercard price target of $441.09 implies 29.73% upside potential. Meanwhile, shares have declined 7.4% over the past six months.

Risk Analysis

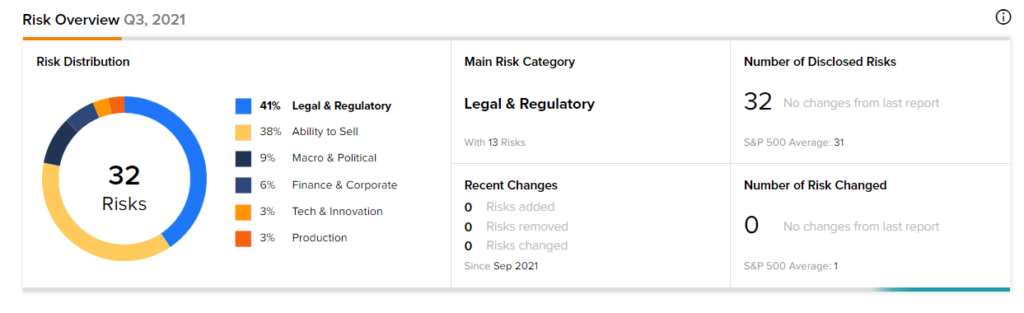

According to the new TipRanks’ Risk Factors tool, the Mastercard stock is at risk mainly from two factors: Legal and Regulatory, and Ability to Sell, which contribute 41% and 38%, respectively, to the total 32 risks identified for the stock.

Related News:

Dell Posts Record Q3 Results on Strong PC Demand

VMware’s Q3 Results Beat Expectations

Plug Power Concludes Buyout of Applied Cryo Technologies