Marten Transport shares fell 8.4% in the extended trading session on Thursday as the company missed analysts’ 3Q revenue estimate. The company offers refrigerated and dry truck-based transportation capabilities.

Marten Transport’s (MRTN) 3Q revenue grew 0.5% Y/Y to $216 million, missing analysts’ forecast of $220.5 million. The top-line was dragged down by a 24% fall in fuel surcharge revenue to $19.9 million, reflecting the impact of significantly lower fuel prices. Excluding fuel surcharges, revenue grew 3.8%.

The company’s 3Q GAAP EPS grew 10% Y/Y to $0.22 and was favorably impacted by a gain of $1.7 million from the disposition of a facility. Analysts expected EPS of $0.20.

CEO Randolph L. Marten commented “We improved our Truckload miles per tractor by 8.5% over the third quarter of 2019 and by 6.2% over the first nine months of 2019, demonstrating our strength of quickly making data-driven decisions and adjustments utilizing our in-house operating technology. We also have been increasing and will continue to increase the compensation for our premium services within the tightening freight market.” (See MRTN stock analysis on TipRanks)

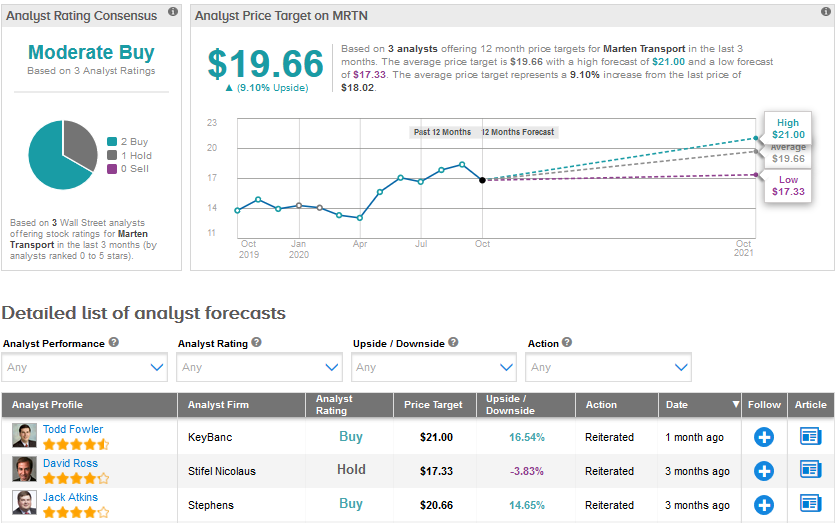

Last month, KeyBanc analyst Todd Fowler reiterated a Buy rating for Marten Transport with a price target of $21.

The Street has a cautiously optimistic Moderate Buy consensus for Marten Transport based on two recent Buy ratings and 1 Hold rating. Shares have risen 25.6% year-to-date and the average analyst price target of $19.66 reflects upside potential of 9.1% for the months ahead.

Related News:

Cars.com Soars 26% On Strong 3Q Sales Outlook, Analyst Upgrade

Raytheon Scores $239M US Air Force Contract Modification

United Airlines Posts Heavy Q3 Loss As Covid Crushes Demand

Questions or Comments about the article? Write to editor@tipranks.com