UK-based Marston’s PLC (GB:MARS) delivered a positive trading update for the 52 weeks that ended on September 28, reporting strong revenue growth. The company experienced a 4.8% increase in LFL (like-for-like) sales in FY24, driven by steady demand for its pubs. According to investment bank Peel Hunt, the company surpassed the managed pub sector’s growth of 4% during the same period.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

MARS stock gained 0.23% as of writing.

Marston’s Expects FY24 Profits in Line with Market Consensus

Marston’s is optimistic about delivering FY24 profits in line with market expectations. The company is confident about achieving its profitability targets based on its focus on cost efficiencies.

Additionally, the company expects its net debt, excluding IFRS 16 lease liabilities, to be around £885 million for FY24. This marks a reduction from the £1.16 billion net debt reported at the end of the first half of the year. The company attributed this improvement to its solid trading performance, coupled with its disposal strategy. Moreover, the sale of its 40% stake in CMBC (Carlsberg Marston’s Brewing Company) and the CMBC dividend received in the first half contributed towards debt reduction.

The growing debt burden remained a challenge for the company despite strong sales momentum due to increased customer spending and the Euro 2024 championship.

Marston’s will announce its preliminary results for FY24 on December 3.

What Is the Target Price for Marston’s?

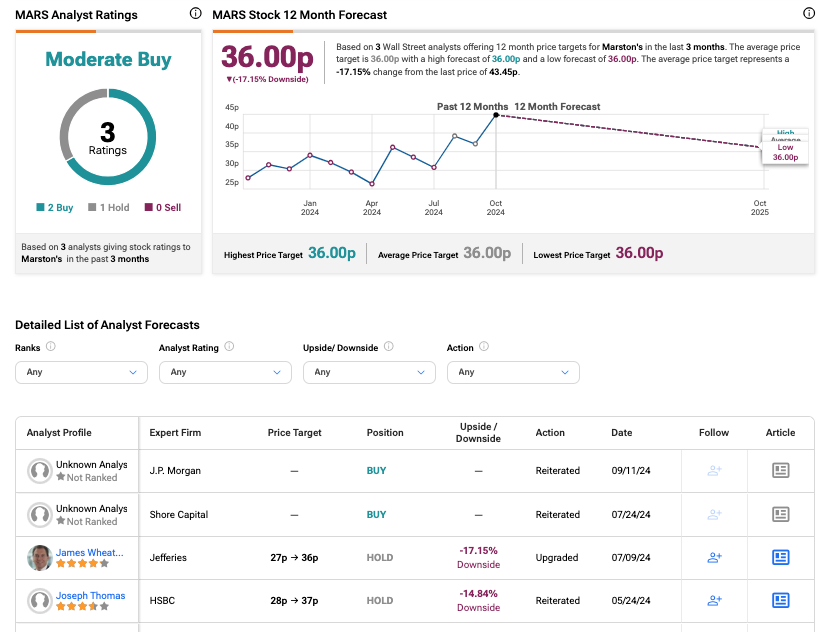

On TipRanks, MARS stock has been assigned a Moderate Buy rating based on two Buys and one Hold recommendation. The Marston’s share price target is 36p, which is 17.15% below the current trading level.

It’s worth mentioning that these ratings were assigned before the announcement and may be subject to change.