Shares of Marriott International (NASDAQ: MAR) jumped 4.7% on Wednesday after the company delivered strong first-quarter results. The American multinational company operates over 7,500 properties across the globe.

Adjusted earnings of $1.25 per share during the quarter surpassed analysts’ estimates of $0.90 per share. The company had posted earnings of $0.10 per share in the same quarter last year.

Revenues jumped 81% year-over-year to $4.2 billion and exceeded consensus estimates of $4.11 billion. The increase in revenues reflected a surge in Base Management and Franchise fees, up 73.1% to $713 million, driven by higher Revenue per available room (RevPAR).

Region-wise, RevPAR in the U.S. and Canada rose nearly 99.1% and 96.5% worldwide.

Meanwhile, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) more than doubled to $759 million, compared to $296 million in the year-ago quarter.

Capital Deployment Activities

The company’s board of directors have approved plans to reinstate a quarterly dividend of $0.30 per share, which is payable on June 30, 2022, to shareholders of record as of May 16, 2022.

Further, on the assumptions of improvement in demand, Marriott expects to resume share repurchases in 2022.

CEO’s Comment

The CEO of Marriott, Anthony Capuano, said, “While there is currently more volatility in our international regions, assuming no major change in the global economic environment or the behavior of the virus, we are increasingly optimistic that the global RevPAR gap compared to pre-pandemic levels will continue to narrow meaningfully in 2022.”

“Owner preference for our brands remains strong. We signed over 19,000 rooms in the quarter, nearly half of which were in international markets. Our momentum around conversions continued, accounting for 22% of room additions in the quarter. Roughly 80% of those conversion rooms were in the high-value upper upscale and luxury tiers. For 2022, we still expect gross rooms growth approaching 5% and deletions of 1 to 1.5%, resulting in anticipated net rooms growth of 3.5 to 4%,” Capuano added.

Wall Street’s Take

Following the results, BMO Capital analyst Ari Klein maintained a Hold rating on Marriott with a price target of $183 (implying 1% upside potential).

Klein said, “An uncertain macro and its impact is a key question moving forward, but for now there is no evidence of a slowdown. While there are still some recovery question marks, increasing capital return should provide support.”

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on five Buys and nine Holds. Marriott’s average stock forecast of $185.92 implies 2.6% upside potential to current levels.

Website Traffic

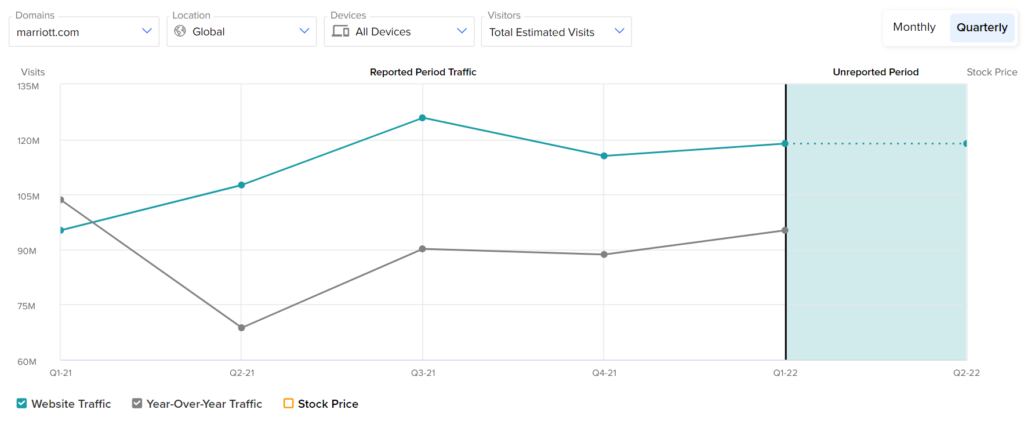

The earnings results were evident on TipRanks’ new tool that measures visits to Marriott’s website. Pre-earnings, we were able to get insights into MAR’s performance in the March quarter.

According to the tool, a website traffic uptrend was visible, which indicated that the company might report strong revenues. In Q1 2022, the total estimated visits on marriott.com trended higher, on a global basis, representing a 24.8% year-over-year jump.

Final Thoughts

Declining COVID cases and a rise in leisure and business travel demand are likely to support Marriott’s topline growth. Further, the bullishness of bloggers and retail investors holding a Smart Portfolio on TipRanks is keeping us optimistic.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Albemarle Bubbles up 15% on Wednesday; Wondering Why?

Uber’s Q1 Revenues in Fast Lane, Up 136%

Why Did eBay Stock Drop Despite Q1 Beat?