When it rains, it pours at Apple (NASDAQ:AAPL), as the tech giant has faced a legion of legal hassles just in the last few weeks. But 2024 likely won’t prove kinder, as new reports suggest the Department of Justice will mount an antitrust effort in just a few weeks. Investors weren’t happy and sent Apple stock down fractionally in the closing minutes of Wednesday’s trading session.

Reports note that the Justice Department might have a case ready against Apple as early as March. Timing, however, might be an issue, as reports note that the most senior brass haven’t permitted the case to go through yet. Given that this is an election year, socking Apple and its shareholders with such a suit might not go over well for a certain president’s re-election chances. This time around, reports note, the antitrust suit will target Apple’s use of hardware and software restrictions against Spotify (NYSE:SPOT), who, in turn, filed a complaint recently in Europe.

And Then Another Hit

And while that was going on, Apple subsequently took another hit from its ongoing patent battle with Masimo (NASDAQ:MASI) over its Apple Watch. The ban on Series 9 sales will resume starting tomorrow—Thursday—thanks to a ruling from the U.S. Court of Appeals. The court didn’t step in on the move to overturn the International Trade Commission’s ban, but rather, took out an injunction that kept the ban from operating while Apple was engaged in appeal. For its part, Masimo noted that it was willing to engage in a settlement, a move that might look increasingly tempting to Apple.

What is the Forecast for Apple Stock?

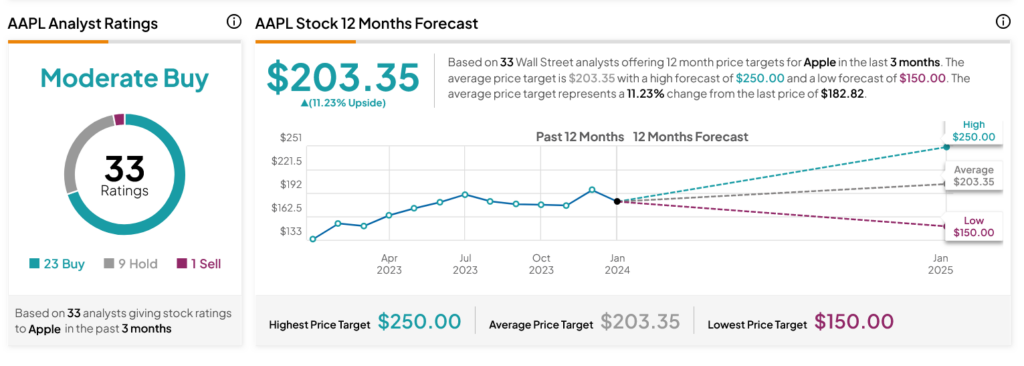

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 23 Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 35.77% rally in its share price over the past year, the average AAPL price target of $203.35 per share implies 11.23% upside potential.