Marathon Petroleum (MPC) has completed the sale of its Speedway convenience-store chain for $21 billion to retailer 7-Eleven. It plans to use the proceeds to buy back shares and pay debts.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Marathon is an American fuel company whose operations include oil refining. It decided to sell Speedway as part of a restructuring plan.

“The close of the Speedway transaction marks a significant milestone in our ongoing commitment to strengthen the competitive position of our portfolio,” said Marathon CFO Maryann Mannen.

After paying taxes tied to the transaction, Marathon will retain $16.5 billion in cash. It plans to use up to $7.1 billion to fund stock repurchase. Including the $2.9 billion still remaining from the previous repurchase plan, the company is now set to buy back up to $10 billion of its stock.

It plans to start with a cash tender offer to repurchase $4 billion of the stock, or 10% of the current market capitalization. The cash tender offer, which the company intends to commence in the coming days, aims to repurchase shares at a price of between $56 and $63. Once that is completed, Marathon plans to spend the remaining amount over the next 12 – 18 months. (See Marathon Petroleum stock analysis on TipRanks)

In addition to the buyback, Marathon has earmarked $2.5 billion for long-term structural debt reduction.

After Marathon announced the closing of the Speedway sale and expanded the repurchase plan, Raymond James analyst Justin Jenkins assigned a Buy rating to the stock.

“We think this will position MPC to offer substantial upside to the cash return story over the next few years (both buybacks and possible dividend increases),” noted Jenkins.

Consensus among analysts on Wall Street is a Strong Buy based on 9 Buy ratings. The average analyst price target of $70.71 implies 17.69% upside potential over current levels.

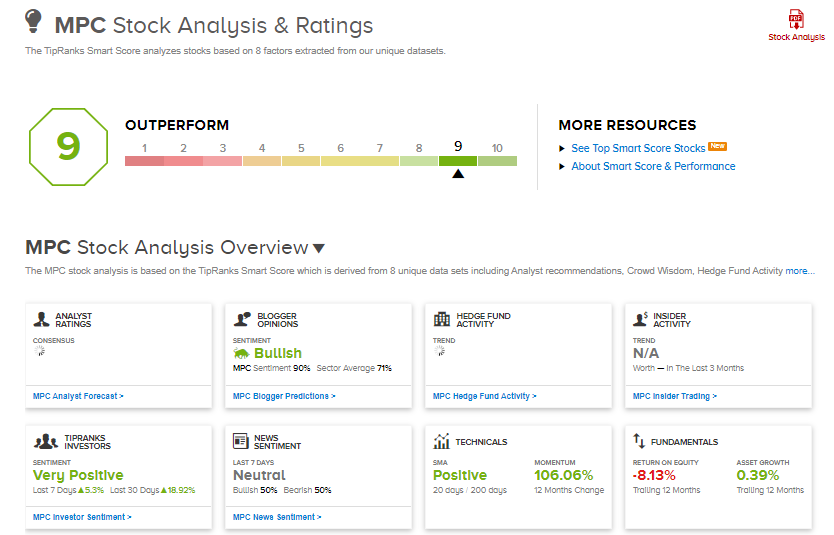

MPC scores a 9 out of 10 on TipRanks’ Smart Score rating system, implying the stock is likely to outperform the market.

Related News:

Alibaba Reports First-Ever Loss Since IPO; Stock Falls 6%

Google Fined €102M in Italy for Anti-Competitive Behavior

Alphabet’s Google Inks Cloud Deals with SpaceX and PayPal