Marathon Digital (MARA) has taken a colossal leap into the Bitcoin market, purchasing 11,774 BTC for $1.1 billion. The move, funded through a zero-coupon convertible notes offering, pushes the firm’s Bitcoin holdings to a staggering 40,435 BTC—worth about $3.9 billion at current prices. This aggressive buy comes as Marathon seeks to reinforce its position as both a miner and a direct investor in Bitcoin.

Marathon Ramps Up Bitcoin Acquisitions

The company announced its purchase via social media, stating it achieved an average acquisition cost of $96,000 per Bitcoin. “Using the proceeds from its zero-coupon convertible notes offerings, MARA has acquired 11,774 BTC for ~$1.1 billion… we hold 40,435 BTC, currently valued at $3.9 billion,” the company shared. This latest acquisition follows November’s purchase of 6,474 BTC, signaling a strong commitment to its Q4 strategy despite challenges earlier in the year, including net losses in Q3.

MicroStrategy and Riot Platforms Double Down

Marathon isn’t alone in going big on Bitcoin. Michael Saylor’s MicroStrategy (MSTR) added 21,550 BTC last week, spending $2.1 billion at an average price of $98,783 per token, according to a regulatory filing. This brought its total holdings to a jaw-dropping 423,650 BTC, worth nearly $42 billion. The purchase was funded through $2.13 billion in share sales, part of the company’s aggressive approach to consolidating its Bitcoin dominance.

Meanwhile, Riot Platforms (RIOT) announced plans for a $500 million convertible note offering, primarily to bolster its Bitcoin reserves. These moves underline a broader trend of corporate faith in Bitcoin as prices recently surged past $100,000, driven by increased U.S. investor activity and ETF inflows.

Is MARA Stock a Good Buy Right Now?

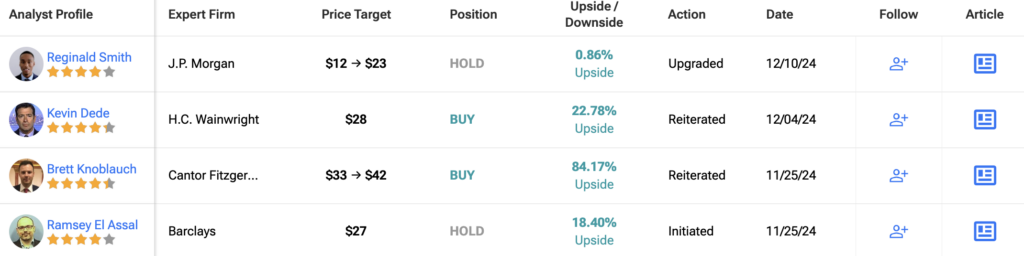

Analysts remain cautiously optimistic about MARA stock, with a Moderate Buy consensus rating based on three Buys and six Holds. Over the past year, MARA has increased by more than 55%, and the average MARA price target of $27.00 implies an upside potential of 18.40% from current levels.