Marriott International (NASDAQ:MAR) shares are ticking lower in the early trading session today after the hospitality major reported a mixed performance for the first quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With a year-over-year increase of 6%, Marriott’s total revenue of $5.98 billion outpaced expectations by $30 million. On the other hand, its EPS of $2.13 lagged consensus by a thin margin of $0.03.

MAR’s Mixed Performance

During the quarter, comparable systemwide constant currency RevPAR (Revenue per Available Room) increased by 4.2% globally. In international markets, this metric stood at a robust 11.1% on the back of gains in the Asia Pacific market (excluding China). In Q1, Marriott added about 46,000 net rooms. Furthermore, the company’s worldwide pipeline at the end of the quarter included nearly 202,000 rooms under construction.

The quarter was marked by a 7% increase in Marriott’s base management and franchise Fees. Its non-RevPAR-related franchise fees also ticked higher on the back of an increase in co-brand credit card fees. Moreover, the company’s incentive management fees ticked up by 4% with a substantial contribution from managed hotels in international markets.

Despite this uptick in revenue, a combination of higher general and administrative expenses and an increase in interest expenses resulted in Marriott’s operating income declining to $876 million from $951 million in the year-ago period.

Marriott’s Forward Guidance

For Fiscal year 2024, Marriott anticipates that worldwide RevPAR will increase by 3% to 5%. Net room growth for the year is anticipated to be in the range of 5.5% to 6%. The company estimates this increase will translate into an adjusted EBITDA of $4.9 billion to $5.1 billion for the full year.

Moreover, Gross Fee revenues in 2024 are expected to hover between $5.18 billion and $5.28 billion. Marriott also anticipates that the EPS will be in the range of $9.31 to $9.65 for the full year.

For the upcoming quarter, Marriott estimates that it will have an EPS of $2.43 to $2.48, alongside a gross fee revenue of $1.34 billion to $1.35 billion.

What Is the MAR Stock Price Forecast?

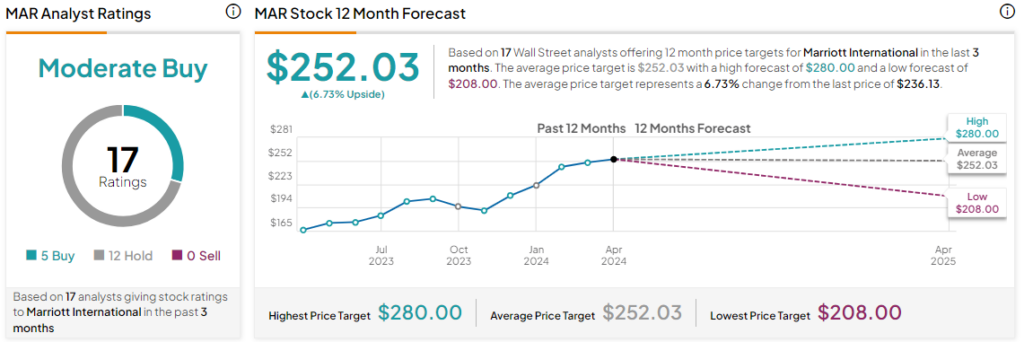

Today’s price decline in Marriott stock comes after a nearly 40% rally over the past year. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average MAR price target of $252.03. However, analysts’ views on the company could see a revision following today’s earnings report.

Read full Disclosure