It appears that institutional investors are continuing to embrace the world of cryptocurrencies. In fact, the National Pension Service (NPS), the world’s third-largest pension fund with nearly $800 billion in assets, recently purchased 24,500 shares of MicroStrategy (MSTR) for $33.75 million, according to an August 13 filing with the U.S. Securities and Exchange Commission. MicroStrategy is a business analytics firm that has heavily invested in Bitcoin (BTC-USD), and its shares rallied on today’s news.

Since 2020, MicroStrategy has acquired 226,500 BTC, now valued at $13.27 billion—a 65% increase from its initial $8.35 billion investment. Other major investors, including the Norwegian and Swiss central banks, have also taken positions in MSTR.

This marks NPS’s second major investment in a crypto-focused company, following last year’s acquisition of 282,673 Coinbase (COIN) shares for $19.92 million. As of the second quarter of 2024, NPS holds $51 million in Coinbase shares, which have surged nearly 150% over the past year.

Is MicroStrategy a Buy?

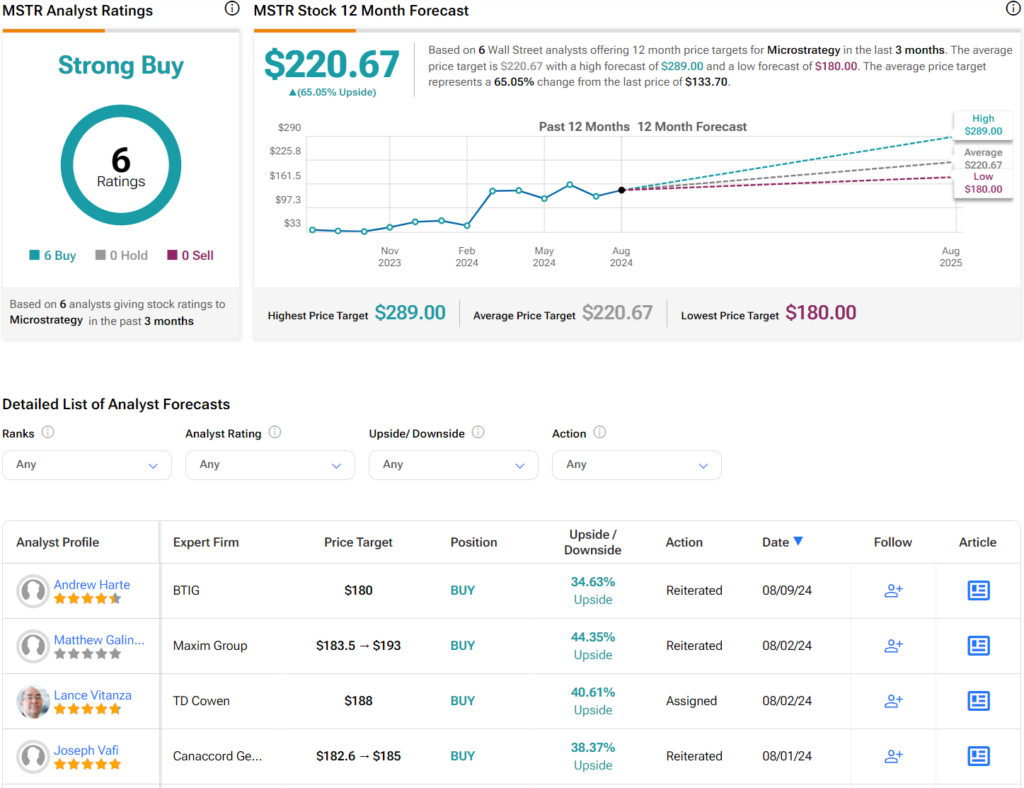

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on six Buys assigned in the past three months. Over the past year, MSTR has increased by a whopping 285%, and the average MSTR price target of $220.67 per share implies an upside potential of 65.05% from current levels.

However, before rushing in to buy MSTR, there are some important risks to consider. Microstrategy has acquired a lot of its Bitcoin holdings using debt. Given the inherent volatility of the crypto market, there’s the risk that the price of Bitcoin could plunge when the debt comes due. That could potentially put the company in a difficult financial situation that could result in big losses for investors.