The present disruptions in the Red Sea are expected to impact global supply chains and potentially contribute to higher prices. However, the crisis is boosting the fortunes of shipping company A.P. Moller- Maersk (OTC:AMKBY) (GB:0O77) (DE:DP4A) as it leads to higher container freight rates. Consequently, Maersk has hiked its financial outlook for the full year.

Maersk’s Improving Fortunes

The Danish company is experiencing robust demand for its services. At the same time, it sees potential port congestions and higher container freight rates building up owing to the crisis in the Red Sea. This, in turn, is anticipated to contribute to a strong performance for Maersk in H2 2024.

Consequently, Maersk now expects EBITDA of $7-9 billion and EBIT of $1-3 billion for the full year. Previously, it estimated EBITDA of $4-6 billion and EBIT of 0 to -$2 billion for the full year. Importantly, Maersk anticipates a free cash flow of $1 billion for 2024. Its prior estimate pegged the figure at -$2 billion.

Comes Amid Challenges in the Red Sea

Over the past few months, the Red Sea shipping disruptions have meant ships taking longer routes via the south of Africa, and the industry facing missed sailings and equipment shortages. These delays are contributing to higher congestion in major ports in Asia and the Middle East.

This dynamic has already contributed to higher shipping prices over the past two months and Maersk sees these challenges persisting over the remainder of 2024. According to Bloomberg, the Red Sea tensions have lowered container-line transits via the Suez Canal by nearly 80%.

What Is the Price Target for Maersk Stock?

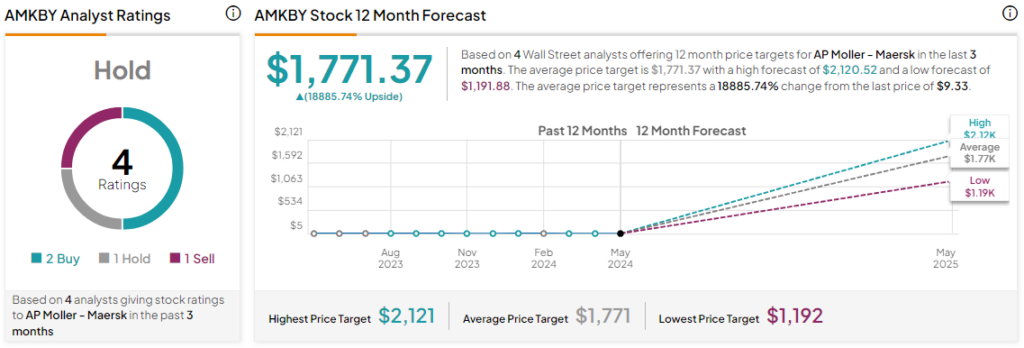

Not surprisingly, Maersk’s share price has rallied by nearly 43% over the past three months. Overall, the Street has a Hold consensus rating on Maersk, alongside an average AMKBY price target of $1,771.

Read full Disclosure