Shipping giant A.P. Moller – Maersk (OTC:AMKBY) (GB:0O77) (DE:DP4A) has been in the limelight this year amid the Red Sea crisis and the Baltimore Bridge tragedy. This week, the Baltimore shipping channel finally reopened after a mammoth wreckage cleanup. Meanwhile, Maersk has provided a key update on the shipping challenges induced by the Red Sea crisis.

Baltimore Port Reopens

This week, the shipping channel into the Baltimore port fully reopened for commercial passage. In March, a container vessel chartered by Maersk collided with the Francis Scott Key Bridge in Baltimore, resulting in the collapse of the entire structure. The ensuing cleanup involved the removal of nearly 50,000 tons of wreckage. The Baltimore port is a key transit point for the U.S. automotive sector.

Sailing via the Cape of Good Hope

In another development, Maersk has provided a key update on the current crisis in the Red Sea, which has resulted in capacity shortages, delays, and a strain on the global supply chain. To safeguard its operations, Maersk’s ships are sailing around the Cape of Good Hope. This has added nearly 4,000 miles to the total voyage length, leading to nearly 40% higher fuel costs for the company compared to a transit via the Red Sea and Gulf of Aden.

The longer voyages have also reduced the available capacity in the shipping industry by around 15%-20% in Q2. To mitigate this impact, Maersk has added nearly 125,000 additional containers to its fleet and is exploring other avenues to expand its capacity. While facing higher costs, Maersk is also benefiting from container freight rate increases. Recently, the company hiked its financial outlook for the full year owing to robust demand for its services.

What Is the Price Forecast for Maersk Stock?

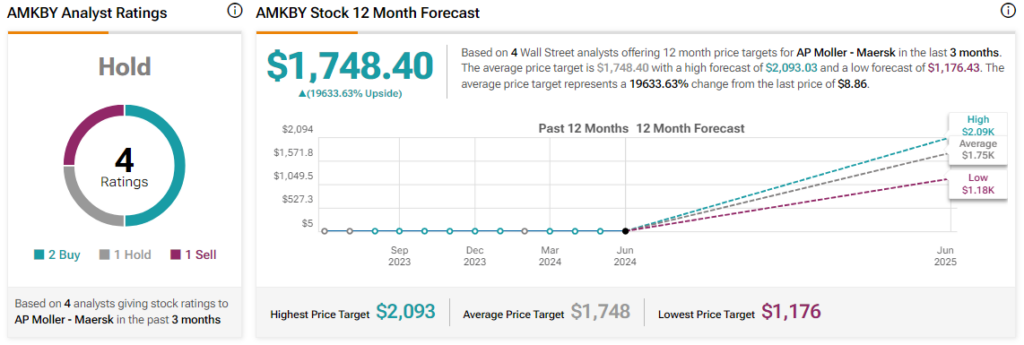

These favorable winds have pushed Maersk’s share price nearly 36% higher over the past three months. Overall, the Street has a Hold consensus rating on Maersk, alongside an average AMKBY price target of $1,748.

Read full Disclosure

Questions or Comments about the article? Write to editor@tipranks.com