Madison Square Garden Entertainment Corp. (MSGE) shares jumped over 16% on Monday to close at $72.55 after the leader in live entertainment reported blowout fiscal Q4 revenue numbers well above analysts’ expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Investors welcomed the growth in revenues, which grew 1,000% to $99.8 million and significantly outperformed consensus estimates of $64.97 million. The increase in revenues reflected a return of live events to the company’s venues after COVID-19-induced restrictions were relaxed during the quarter.

Markedly, Madison Square Garden in New York and other locations hosted many sold-out events during the quarter. (See Madison Square Garden Entertainment stock charts on TipRanks)

Encouragingly, many markets in the U.S. witnessed the easing of capacity restrictions allowing several venues to operate at 100% capacity during the quarter.

Segment-wise, the Entertainment segment’s revenues grew 264% year-over-year to $31.1 million driven by several commercial arrangements with MSG Sports.

On top of this, the Tao Group Hospitality segment’s revenues bounced to $69.7 million compared to $1.3 million in the prior-year period, aided by the easing of capacity restrictions as well as the Hakkasan Group acquisition completed in April.

However, the company reported an adjusted operating loss of $70.0 million during the quarter compared to an adjusted loss of $103.5 million in the year-ago quarter.

MSGE CEO James L. Dolan commented, “While we continue to operate in a fluid environment, we remain cautiously optimistic as we prepare to meet the pent-up demand for live experiences and, after the MSG Networks acquisition, move forward with greater scale and enhanced financial flexibility to pursue growth opportunities and deliver long-term value for shareholders.”

Morgan Stanley analyst Benjamin Swinburne recently resumed coverage on MSGE with a Sell rating and a price target of $65 (10.4% downside potential).

Overall, the stock has a Hold analyst consensus rating based on 1 Buy, 1 Hold, and 1 Sell. The average Madison Square Garden Entertainment price target of $92 implies 26.8% upside potential from current levels.

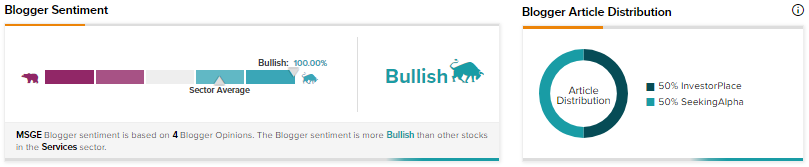

TipRanks data shows that financial blogger opinions are 100% Bullish on MSGE, compared to a sector average of 70%.

Related News:

Boqii Holding Delivers Q1 Beat; Shares Rise 3.6%

Nokia Expands 5G Footprint with A1 Telekom into New Markets

Timken Snaps up Intelligent Machine Solutions