Macy’s, Inc. (M) shares jumped almost 20% on Thursday to close at $21.61 after the American retailer delivered a blowout second-quarter results, reinstated dividends and share buybacks, and also raised its FY2021 guidance well above analyst expectations.

The quarterly beat was driven by the positive impact from its Polaris turnaround strategy along with the economic rebound as an increased number of younger customers returned to the Macy’s stores.

Encouragingly, adjusted earnings of $1.29 per share significantly beat analysts’ expectations of $0.13 per share. The company reported an adjusted loss of $0.81 per share in the prior-year period.

Net sales jumped 58.7% year-over-year to $5.65 billion and exceeded consensus estimates of $4.96 billion. Comparable sales increased 61.2% year-over-year and grew 5.8% on a 2-year stack basis.

Markedly, 5 million new customers were added during the quarter, implying an increase of 30% versus pre-pandemic levels in Q22019. (See Macy’s stock charts on TipRanks)

On top of this, gross margin grew 17 percentage points to 40.6% compared to 23.6% a year ago and increased 180 basis points versus the second quarter of 2019.

The margin improvement was attributable to strong pricing momentum as well as the benefits of promotion and inventory initiatives driven by the Polaris strategy.

Macy’s Announces 10.3% Return to Shareholders Via Dividends and Buybacks

Given a healthier, de-levered balance sheet, the company announced its plan to enhance shareholders’ returns by resuming its dividend and share repurchase programs.

The company reinstated a dividend of $0.15 per share, which will lead to an annual return to shareholders of nearly $200 million, or 2.9% of the current market capitalization. The dividend is payable on October 1 to shareholders of record on September 15.

Further, the company announced a share repurchase program worth $500 million, or 7.4% of its current market capitalization.

Macy’s Raises FY2021 Guidance Above Expectations

Based on strong Q2 results and the growing traction of the Polaris strategy, the company significantly raised its guidance for Fiscal 2021.

The company now forecasts adjusted earnings in the range of $3.41 to $3.75 per share, while the consensus estimate is pegged at $2.24 per share. Adjusted earnings were previously expected to range between $1.71 and $2.12 per share.

In addition, revenues are forecast to be in the range of $23.55 – 23.95 billion, versus the consensus estimate of $22.12 billion. This compares to the prior revenues guidance range of $21.73 – 22.23 billion.

Macy’s CEO Jeff Gennette, “Through the Macy’s, Inc. portfolio and our omnichannel approach, we provide a compelling, seamless integration between physical stores and digital shopping to most effectively meet the needs of our customers.”

Gennette further highlighted, “The Polaris strategy is working. We have meaningfully improved the fundamentals and overall health of our business, and we are well underway building a stronger Macy’s, Inc. for the future.”

Following the outstanding Q2 results and positive announcements, Morgan Stanley analyst Kimberly Greenberger increased the price target on Macy’s from $17 to $21 (2.8% downside potential) and reiterated a Sell rating.

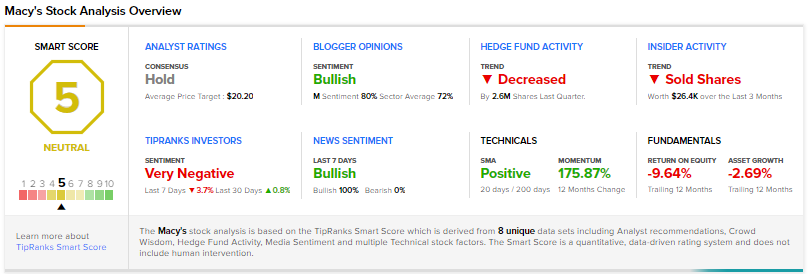

Consensus among analysts is a Hold based on 2 Buys, 2 Holds, and 2 Sells. The average Macy’s price target of $21.75 implies that shares are fully priced at current levels.

Macy’s scores a 5 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations.

Related News:

Bath & Body Works Pops 4.3% after Upbeat Q2 Results

TJX Reports Quarterly Beat; Shares Surge 5.6%

DLocal Delivers Upbeat Results in Q2; Shares Soar 24%