Vista Outdoor (NYSE:VSTO) received a revised offer from MNC Capital Partners of over $3 billion, or $39.50 per share, to acquire all the company’s outstanding shares today. Late last month, Vista Outdoor rejected MNC Capital’s earlier offer of $37.50 per share, stating that the offer “significantly” undervalued the company.

MNC Capital’s revised offer represents a more than 30% premium to VSTO’s last closing price before MNC’s initial offer. Additionally, MNC’s revised offer implies a value for Revelyst of over $1 billion, significantly higher than Vista’s valuation for Revelyst at $570 million. Revelyst is Vista’s outdoor products business.

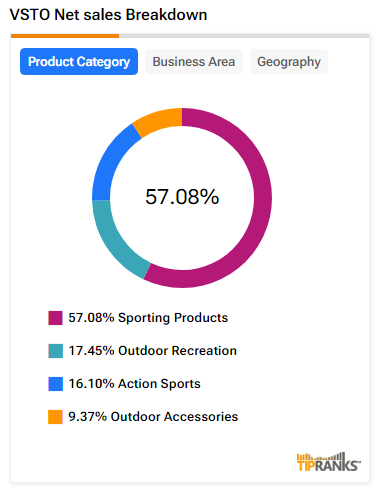

VSTO’s Sales Breakdown

MNC’s offer comes even as Vista has yet to complete the separation of its outdoor sports and recreation products businesses.

Furthermore VSTO’s sporting products business is an important component and comprises more than 50% of its total revenues.

Last month, the company agreed to sell its sporting products business to Czechoslovak Group for $1.96 billion.

What Is the Price Target for VSTO?

Analysts remain cautiously optimistic about VSTO stock, with a Moderate Buy consensus rating based on two Buys and one Hold. Over the past year, VSTO has increased by more than 25%, and the average VSTO price target of $38.33 implies an upside potential of 7.1% from current levels.