Taiwan’s Federal Trade Commission (FTC) has blocked Uber Technologies’ (UBER) proposed $950 million acquisition of Delivery Hero’s (DE:DHER) Foodpanda business on competitive concerns. The ride-hailing giant announced the agreement to acquire Foodpanda in May 2024, saying that it expects the deal to strengthen its position in Asia and contribute at least $150 million annually to the adjusted core profit of its delivery business within one year of its completion.

Here’s Why Taiwan’s FTC Opposed Uber’s Foodpanda Deal

Taiwan is a highly competitive market, where online food delivery providers still account for a small part of the food delivery landscape. Noting that the merged entity will have over 90% market share on completion, Taiwan’s FTC vice chairman Chen Chi-ming stated, “If Uber acquires Foodpanda, it will be completely unrestrained by competition.”

The regulatory body contends that following the merger, UberEats will face less competition. This will give it more power to raise prices and increase commissions for restaurants, thus harming consumers. Chi expressed concerns that no corrective measures can ensure that competition can be sustained if this deal goes through.

Chen explained that the FTC’s decision follows its economic analysis to gauge the impact of this deal on competition. The analysis was based on the feedback from more than 600 responses from food delivery platforms and relevant agencies. The FTC’s decision was welcomed by Taiwan’s trade union, which had earlier expressed concerns that this deal would create a monopoly and cause massive losses for delivery riders, vendors, and customers.

Is UBER Stock a Buy, Sell, or Hold?

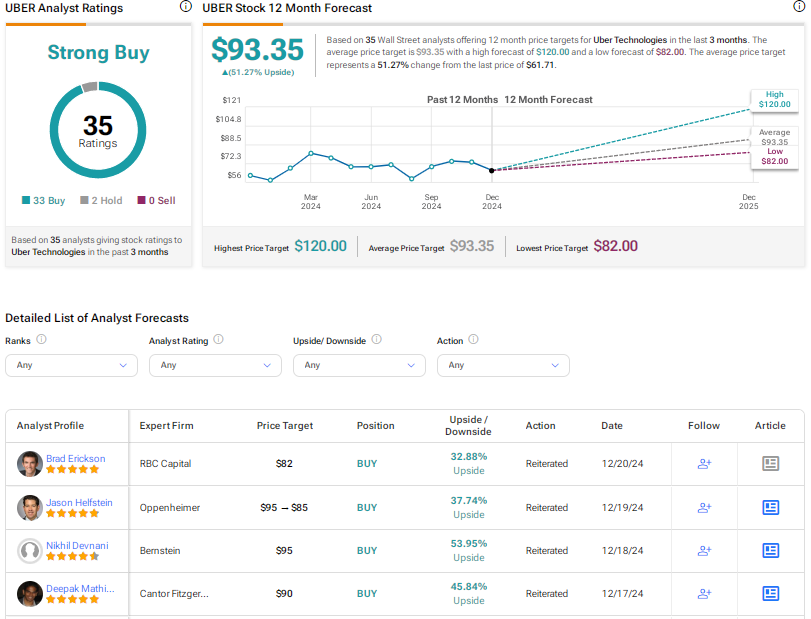

Despite this setback, analysts are bullish on Uber Technologies stock, given its strong fundamentals and dominant position in the ride-hailing and food delivery space. UBER scores a Strong Buy consensus rating on TipRanks, backed by 33 Buys and two Holds. The average UBER stock price target of $93.35 implies 51.3% upside potential.