The Edgar Bronfman Jr. offer to acquire entertainment giant Paramount (PARA) was over nearly as quickly as it had begun. Indeed, the Seagrams heir and his coterie of investors suddenly retracted the whole thing despite it being on the table for less than a week. Investors did not take it well, and Paramount shares plunged over 6% in Tuesday afternoon’s trading.

Why Bronfman departed, meanwhile, is much less clear. Bronfman notified Paramount’s director committee tasked with overseeing the offer that he would exit the process and followed that up with vague mutterings about Paramount being “an extraordinary company” with “an unrivaled collection of marquee brands, assets, and people.”

However, reports noted that Bronfman needed to submit an expanded bid offer this week, with “…more clarity around his financing commitments.” That might have had something to do with it, especially if some of Bronfman’s investors pulled out.

Paramount Looks to Sell 12 Local Television Stations

Meanwhile, Paramount—still careful about its cash flow even after a flood of layoffs and other cost-cutting measures—is making moves to save more cash, this time by selling 12 local television stations. The stations in question are scattered across the map, including major markets like New York, Tampa, and Dallas.

Reports suggest that the sale of the 12 stations in question could generate as much as $1 billion for Paramount at a time when it is looking to shore up its liquidity. And those who purchase the stations can tailor their offerings to the local market accordingly, which could be potentially lucrative in the right hands.

Is Paramount a Good Stock to Buy Now?

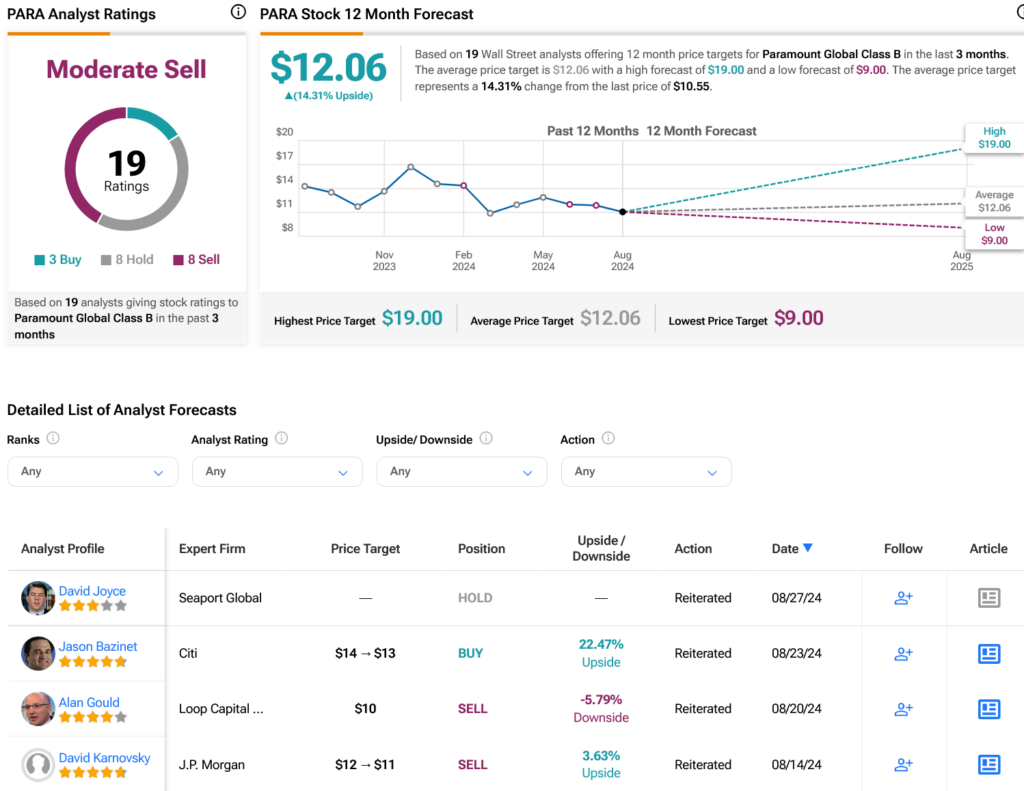

Turning to Wall Street, analysts have a Moderate Sell consensus rating on PARA stock based on three Buys, eight Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. After a 26.79% loss in its share price over the past year, the average PARA price target of $12.06 per share implies 14.31% upside potential.