Nvidia (NASDAQ:NVDA) plans to acquire Shoreline.io, Bloomberg reported. Shoreline.io is a startup that develops software solutions for system incident management and process automation. According to the report, the deal values Shoreline.io at approximately $100 million. This marks another strategic acquisition by Nvidia to enhance its AI and automation software capabilities.

This deal follows Nvidia’s recent acquisition of Run:ai, a workload management and orchestration software provider. Additionally, Nvidia has been in discussions to acquire Deci, an AI startup that facilitates the development and deployment of AI models by developers.

The Rationale Behind These Acquisitions

Nvidia’s recent acquisitions reflect its strategy to bolster its offerings for enterprise customers and make AI deployments cost-effective. By acquiring Shoreline.io, Nvidia plans to enhance its portfolio with advanced software solutions that identify and resolve system issues.

The acquisitions of AI-centric startups like Run:ai and potentially Deci further strengthen Nvidia’s offerings for managing and optimizing compute infrastructure. These capabilities are crucial for reducing the complexity and cost of AI deployments.

Consequently, the buyouts will make Nvidia’s products more attractive to enterprise customers and drive demand for its graphics processing units (GPUs).

In summary, these deals allow Nvidia to continue diversifying its offerings and solidifying its leadership in AI technology.

Nvidia’s Rise as the Most Valuable Company

NVDA stock has surged approximately 174% year-to-date, following an impressive 239% increase in 2023. Thanks to the rally in its shares, Nvidia surpassed Microsoft (NASDAQ:MSFT) to become the most valuable company in the U.S., and its market cap soared past the $3.34 trillion mark.

This rally in Nvidia stock reflects its leadership in the AI segment. The robust demand for its GPUs powering AI applications has bolstered its financials and stock price. Further, its sales and earnings could continue to grow at a breakneck pace, fueled by robust demand for the NVIDIA Hopper GPU computing platform and new product launches.

As the ascent in NVDA stock continues, let’s look at the Street’s forecast.

Is Nvidia a Buy, Sell, or Hold?

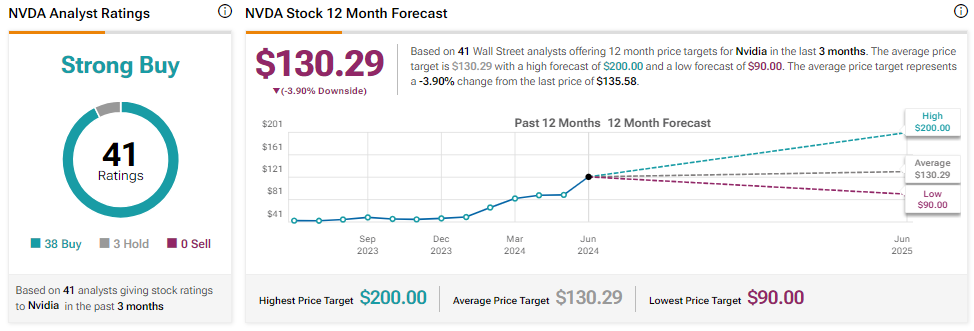

Wall Street is bullish about NVDA’s prospects. The stock sports a Strong Buy consensus rating based on 38 Buys and three Hold recommendations. The analysts’ price target on NVDA stock is $130.29, implying 3.9% downside potential from current levels.