Nordstrom (NYSE:JWN) could be taken private by Sycamore Partners, a buyout equity firm, according to an exclusive report by Reuters. The report stated that negotiations are currently ongoing and may take weeks, with no guarantee of a deal.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

As consumers pull back on discretionary spending due to high inflation and rising interest rates, retailers like Nordstrom are increasingly becoming a takeover target. JWN had a long-term debt of $2.9 billion, as of the end of December and currently has more than 350 stores.

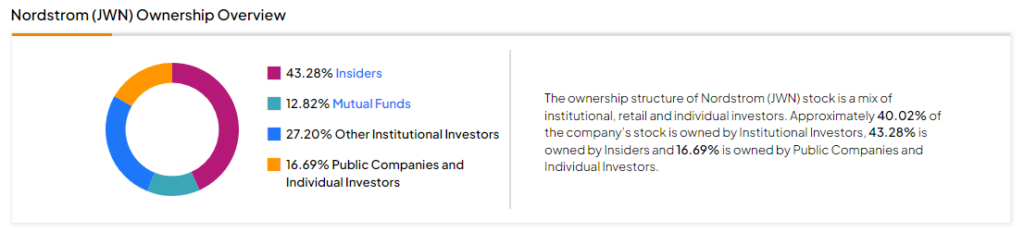

Ownership of Nordstrom

Earlier this year, the luxury department store retailer had stated that its CEO, Erik Nordstrom, and his family were interested in taking the retailer private. Erik Nordstrom and his family collectively have a stake of 30% in the company. Whether or not the company ends up being acquired, it’s probably a good sign for investors that the family is remaining committed to the company.

Indeed, the TipRanks’ Ownership tool indicates that insiders own 43.3% of the company. Meanwhile, mutual funds and institutional investors have a stake of 12.8% and 27.2%, respectively, as indicated by the graphic below.

Is JWN Stock a Good Buy?

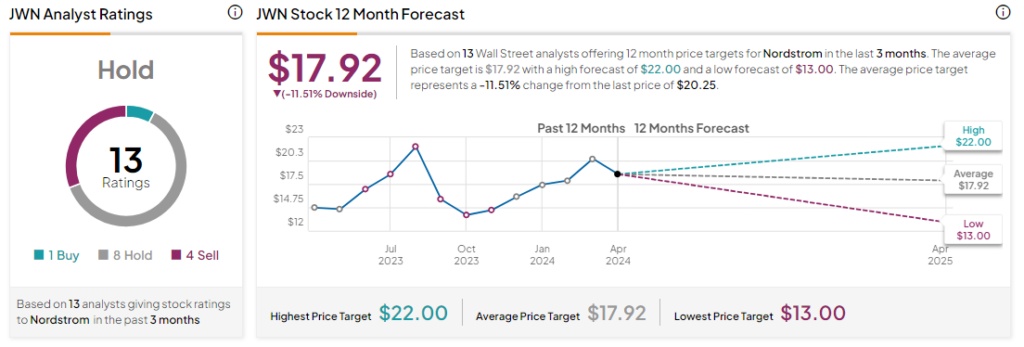

Analysts remain sidelined about JWN stock, with a Hold consensus rating based on one Buy, eight Holds, and four Sells. Over the past year, JWN has increased by more than 40%, and the average JWN price target of $17.92 implies a downside potential of 11.5% from current levels