Networking solutions and software services provider Nokia (NYSE:NOK) is buying Infinera (NASDAQ:INFN) for $6.65 per share, or $2.3 billion. Inferia is a provider of optical networking solutions.

Nokia’s offer represents a significant premium of 28% over INFN’s closing price on June 26. Moreover, it offers a 37% premium to INFN’s trailing 180-day volume-weighted average price. Thanks to the deal, Infinera stock jumped over 18% in Thursday’s after-hours trading.

The Deal Structure

Nokia said the company will pay at least 70% cash to acquire Infinera. Moreover, Infinera shareholders can receive up to 30% of Nokia’s American Depositary Shares (ADSs).

Further, Nokia will accelerate share buybacks to offset the impact of dilution from this deal. The transaction will likely close in the first half of 2025.

Nokia to Boost its Scale in Optical Networks

The deal will enable Nokia to increase its scale in optical networks and speed up product development. Moreover, it will enhance its competitiveness in optical technology, primarily in North America. In addition, Nokia will attract a broader range of customers and expand its reach among web-scale clients.

The combined business is expected to help Nokia achieve a double-digit operating margin in its optical network business. Further, Nokia aims to achieve €200 million in operating profit synergies by 2027.

In summary, Infinera’s deal and recent divestiture of Submarine Networks will reshape Nokia’s infrastructure business and improve its operating margin. Moreover, it is projected to be accretive to Nokia’s EPS in the first year after closing.

Is Nokia Stock a Good Buy Now?

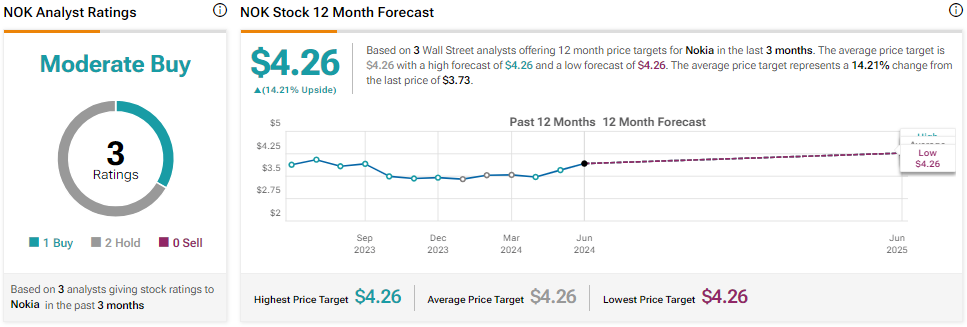

Nokia stock has one Buy and two Hold recommendations for a Moderate Buy consensus rating. The analysts’ NOK stock price target is $4.26, implying a 14.21% upside potential from current levels. Nokia stock is down by about 7% year-to-date.