And the band plays on at Paramount (NASDAQ:PARA). Anyone who thought that the Paramount and Skydance deal was a sure thing will be disappointed, as new reports say an agreement won’t be reached by the end of the month. Since that’s how long Skydance has to make an exclusive deal happen, it suggests that Skydance won’t be buying in before May. Shareholders cheered, sending media giant Paramount up over 4% in Wednesday afternoon’s trading.

Skydance’s window of exclusivity comes to an end somewhere around May 3, and the latest reports suggest a deal coming through on that day—about two weeks out—is not likely to happen. It’s a safe bet the market didn’t expect that based on the sudden gains that hit today. With reports also suggesting that $3 billion worth of cost-cutting measures could follow any such deal, it’s easy to see why it needs more time. This is likely good news to Byron Allen, who revealed that he was still interested.

Paramount Working Toward Building Its Future

Meanwhile, Paramount is actively working toward building its future, regardless of the outcome of any potential deal. We’ve already heard about several of the upcoming movies, but there’s one more that emerged of particular consequence in light of the death of O.J. Simpson. Liam Neeson and Pamela Anderson will be teaming up for a remake of Naked Gun, to be produced by Fuzzy Door, Seth MacFarlane’s production company.

Further, Paramount promoted Ryan Briganti to head its sports division’s advertising sales efforts, taking over for recent retiree John Bogusz. Briganti served as senior vice president of ad sales for both CBS Sports and CBS Sports Digital.

Is Paramount Stock a Good Buy?

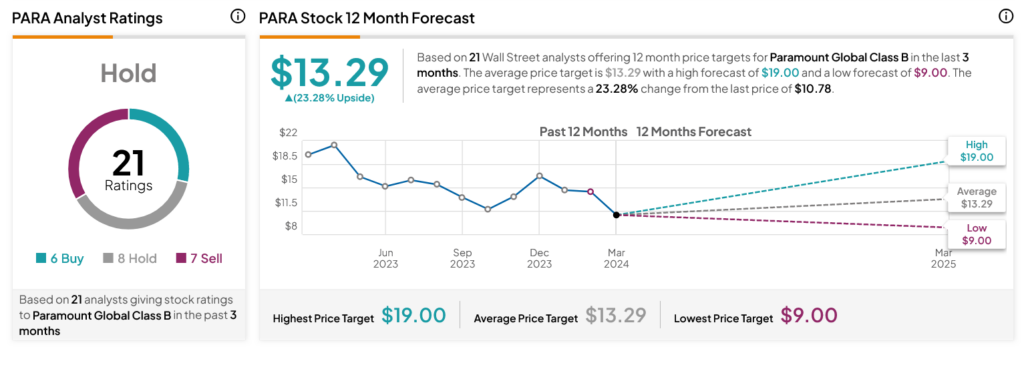

Turning to Wall Street, analysts have a Hold consensus rating on PARA stock based on six Buys, eight Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 49.74% loss in its share price over the past year, the average PARA price target of $13.29 per share implies 23.28% upside potential.

Is PARA the Right Stock to Buy for Passive Income?

Before you hurry to invest in PARA, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and Paramount is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.