Privatized spacecraft are becoming increasingly popular for businesses. And now, aerospace company Lockheed Martin (LMH) is taking a step into that field. It recently agreed to acquire Terran Orbital (LLAP) and privatize the company for a comparative discount. Investors were less than pleased as Lockheed shares slipped fractionally in Thursday afternoon’s trading.

Lockheed agreed to buy in on Terran Orbital for an enterprise valuation of around $450 million. That is a significant discount from Lockheed’s previous attempt valued at $600 million back in March. But Terran Orbital bit on the new offer, reduced as it may have been.

Lockheed agreed to pay off Terran Orbital’s debt and pay shareholders a whopping $0.25 per share for all outstanding common stock. Given that shares closed at around three times that just a week ago, this suggests that Terran Orbital wanted to get out while the going was good. But Lockheed also threw in a $30 million capital facility to help keep Terran Orbital up and running until the deal closed.

Pushing into Space

So, while this move gives Lockheed access to a spacefaring play for comparatively cheap, it’s been working to develop a new string of infrastructure that will help push for more space operations, as well as take care of some less inspirational tasks on Earth. It, along with General Dynamics (GD), has been working to develop its own line of rocket motors.

Rocket motors have been in short supply lately, which has impacted everything from Chinese relations to the Ukraine-Russia war. Now, General Dynamics will produce “thousands of solid rocket motors per year” in an exclusive deal with Lockheed Martin.

Is Lockheed Martin a Buy, Sell, or Hold?

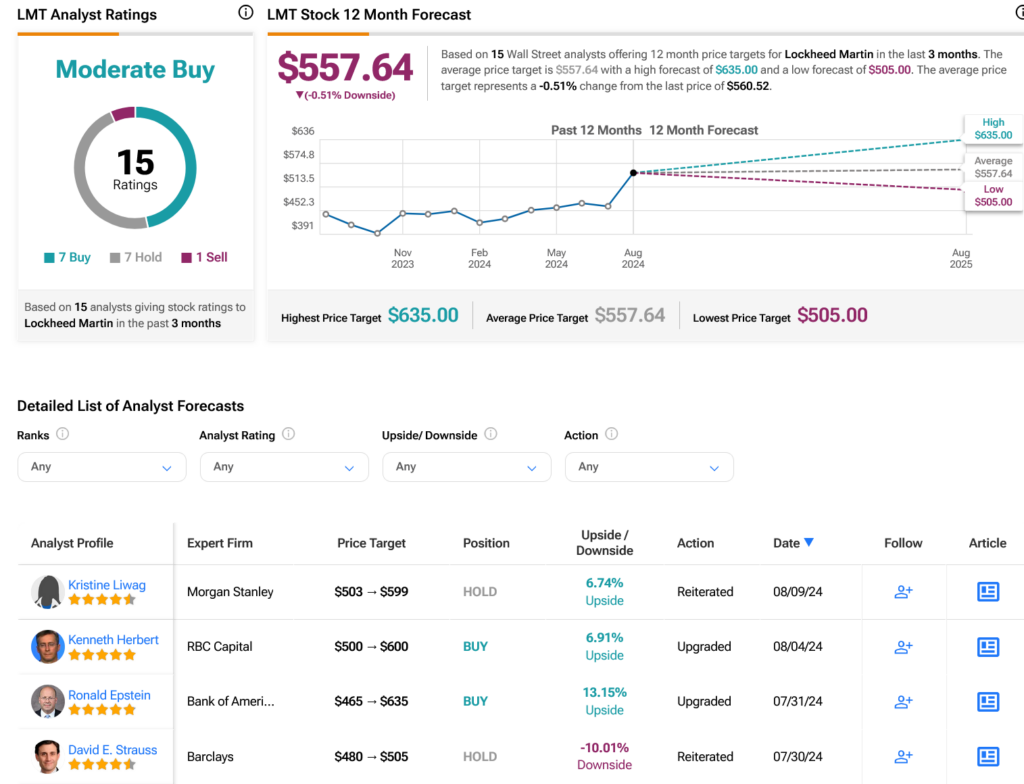

Turning to Wall Street, analysts have a Moderate Buy consensus rating on LMT stock based on seven Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 29.63% rally in its share price over the past year, the average LMT price target of $557.64 per share implies 0.51% downside risk.