According to the Wall Street Journal, Macy’s (NYSE:M) has received a sweetened buyout offer from the investor group, which consists of the real estate investment firm Arkhouse Management and global asset manager Brigade Capital Management. The group has raised its offer to acquire the company by $300 million to about $6.9 billion.

Macy’s is an American department store chain that offers apparel, accessories, and home goods. For a thorough assessment of the stock, go to TipRanks’ Stock Analysis page.

Second Bite at the Apple

Interestingly, the latest buyout offer marks the investor group’s second attempt to make the bid more lucrative. The new proposal targets acquiring Macy’s outstanding shares for $24.80 each, which reflects a nearly 38% premium to Macy’s closing price on Wednesday.

This follows their previous attempt in March, when the investor group raised the offer to $24 per share from the initial December 2023 proposal of $21 per share.

Macy’s to Weigh the Offer

With a higher bid on the table, Macy’s is now faced with a crucial decision: whether to accept the potential acquisition offer or continue with its turnaround plan. Interestingly, Macy’s announced a new business strategy, called A Bold New Chapter, in February.

Under this strategy, the company plans to focus on expanding its luxury stores. Additionally, the company aims to grow its beauty brand, Bluemercury, which has been experiencing strong demand. At the same time, Macy’s is closing underperforming stores and renovating those with better sales.

Importantly, Macy’s seems to believe that the strategic initiatives are working, as the company raised its FY24 outlook in May. The retailer now expects to report adjusted earnings between $2.55 and $2.90 per share, compared to its prior outlook of $2.45 to $2.85 per share.

Is Macy’s Stock a Buy or Sell?

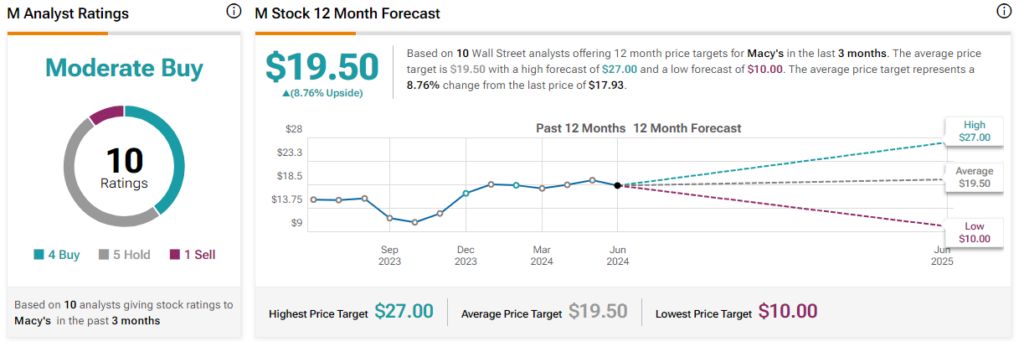

Overall, Macy’s has a Moderate Buy consensus rating based on four Buy, five Hold, and one Sell ratings. The analysts’ average price target on Macy’s stock of $19.50 implies an 8.76% upside potential from current levels. Meanwhile, the stock has declined 9.3% year-to-date.