Shares of ASX-listed HMC Capital Ltd. (AU:HMC) gained nearly 2% today after the company agreed to acquire the operating assets and development pipeline in Victoria from France-based Neoen (FR:NEOEN) for $950 million. As part of the deal, HMC Capital, previously known as Home Consortium, acquired a portfolio of renewable energy generation and storage assets. The acquisition boosts HMC’s assets under management (AUM) to $19 billion, which remains on track to surpass the $20 billion AUM target in FY25.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

HMC Capital is an asset manager that invests in real assets for individuals, large institutions, and superannuation funds. Meanwhile, Neoen is a global renewable energy company with operations across multiple continents.

HMC Capital’s Strategic Move in Renewables

This acquisition marks a strategic expansion for HMC Capital in the renewables sector. The portfolio includes four operational assets with 652MW (megawatt) of installed wind, solar, and BESS capacity, along with six development assets totaling over 2,800MW in capacity.

Meanwhile, the acquisition price of $950 million includes $750 million due at the Fiscal Year-end in July 2025 and the remaining $200 million payable in December 2025. The company also highlighted that the purchase price is below the replacement cost of the operating assets, and the acquisition comes with a substantial growth pipeline.

Additionally, the acquisition is expected to be immediately earnings accretive after FY26.

Is HMC Capital a Good Stock to Buy?

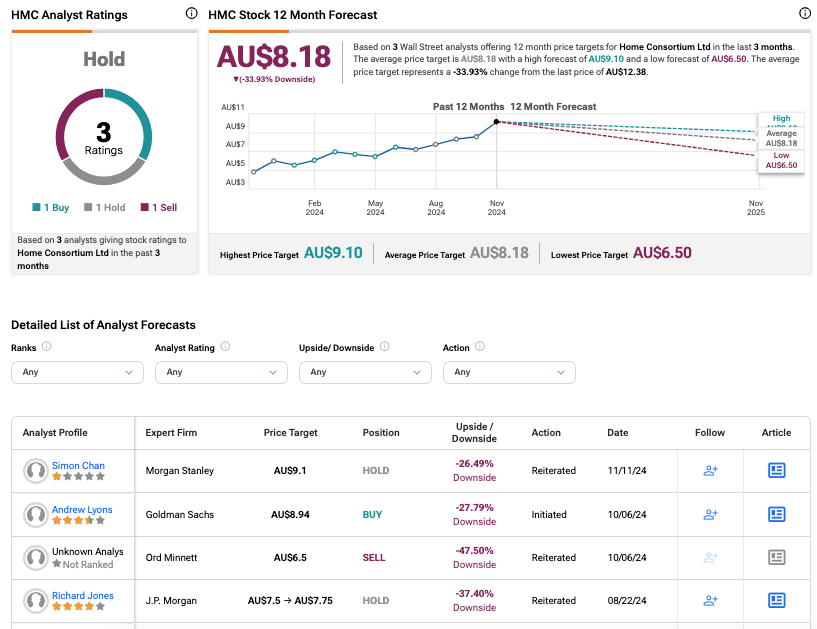

Year-to-date, HMC stock has gained a massive growth of over 100%, driven by its solid operational performance. Moving ahead, analysts remain cautious about the stock after this tremendous growth. According to TipRanks, HMC stock has received a Hold consensus rating based on one Buy, one Hold, and one Sell recommendation. The HMC Capital share price target is AU$8.18, which is 34% below the current price level.