Entertainment giant Disney (NYSE:DIS) and the Indian conglomerate Reliance Industries have inked an agreement to merge their media operations in India, Bloomberg reported. This strategic move by Disney is aimed at restructuring its portfolio in response to challenges it faces in the world’s most populous country.

Per the agreement, Reliance’s media unit will likely hold a minimum of 61% ownership in the combined entity, while Disney will retain the remaining stake. However, the distribution of ownership could change when finalizing the deal.

Disney’s India Challenges

Disney has faced hurdles in India, particularly in sustaining its subscriber base within its streaming business. Notably, the company opted for a free broadcast of matches during last year’s ICC Cricket World Cup to bolster its subscriber numbers. This resulted in a significant surge in viewership on its platform during the event. That said, it exerted pressure on the overall profitability of the company’s Sports division due to escalated rights expenses.

During the Q4 conference call, Disney’s CEO Robert Iger acknowledged that while the company’s linear business in India is performing well and generating profits, the streaming platform remains challenged. Nonetheless, Iger emphasized that the company would stay in the Indian market and enhance the bottom line.

While Disney is focusing on accelerating growth, it is battling a proxy contest with activist hedge funds regarding the restructuring of its Board.

Is Disney a Buy, Sell, or Hold Stock?

Disney stock is up over 19% year-to-date, outperforming the S&P 500’s (SPX) gain of 6.7%. This notable growth in DIS stock reflects its efforts to cut costs and turn around its business. However, analysts remain cautiously optimistic about Disney’s prospects.

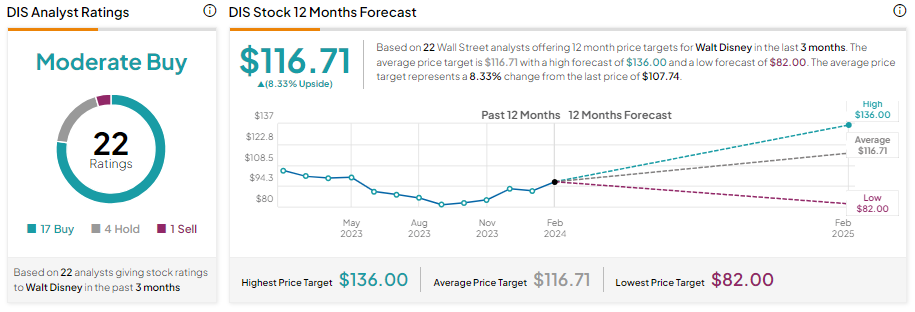

DIS stock has 17 Buys, four Holds, and one Sell recommendation for a Moderate Buy consensus rating. Analysts’ average DIS stock price target of $116.71 implies a limited upside potential of 8.33% over the next 12 months.