American steel producer Cleveland-Cliffs (CLF) has shown its eagerness to buy assets from U.S. Steel (X) if the buyout deal by Japan’s Nippon Steel (JP:5401) fails. Cleveland-Cliffs’ CEO Lourenco Goncalves issued a press release yesterday to show his support to President Joe Biden, who is opposing Nippon’s $14.1 billion acquisition of U.S. Steel. X shares rose 2.2% in after-hours trading in reaction to the news.

Interestingly, Goncalves stated that his company is ready to immediately buy all the union-represented assets of U.S. Steel in case of a shutdown. On September 4, U.S. Steel warned that it would shut down plants and move its headquarters from Pittsburgh if the Nippon deal fell apart. Goncalves called the threat a “pathetic blackmail attempt” and assured that it had the finances in place to make an immediate buyout. The U.S. Streel-Nippon deal has faced similar criticism from Presidential candidates Kamala Harris and Donald Trump.

Cleveland-Cliffs’ Escalating Efforts to Buy U.S. Steel

Cleveland-Cliffs had earlier attempted to acquire U.S. Steel in 2023, but was turned down by the latter since its purchase price of $54 cash-and-stock deal was a dollar less than Nippon’s offer. Goncalves even went on to state that U.S. Steel’s management was adamant about selling the company to foreign investors. He re-emphasized the importance of the American steel industry in safeguarding national security and union jobs and stressed that American steel manufacturing must remain in American hands.

U.S. Steel has been under immense pressure due to underperforming financial performance and a declining stock price. Steel prices have been falling, with an approximate 40% drop this year. Rising steel exports from China and diminishing domestic demand in the U.S. have impacted steel players.

Meanwhile, Cleveland-Cliffs’ possible acquisition of U.S. Steel could also see heightened regulatory scrutiny as the deal has a monopolistic nature and could threaten competition. Moreover, some believe that it would be difficult for CLF to raise such large sums immediately. Cleveland-Cliffs is also in the midst of its recently announced acquisition of Canadian steelmaker Stelco Holdings (TSE:STLC) for $2.8 billion.

Is Cleveland-Cliffs Stock a Buy or Sell?

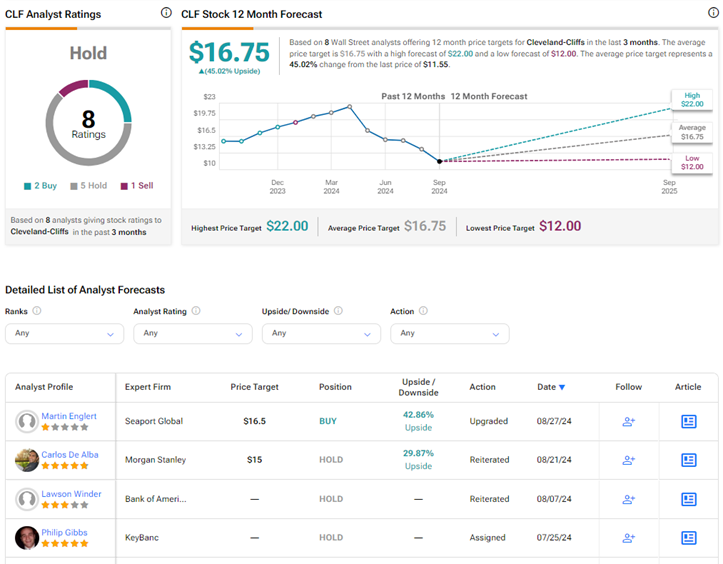

Owing to the current headwinds for the steel sector, analysts prefer remaining on the sidelines on CLF stock. On TipRanks, CLF stock has a Hold consensus rating based on two Buys, five Holds, and one Sell rating. The average Cleveland-Cliffs price target of $16.75 implies 45% upside potential from current levels. Year-to-date, CLF shares have lost 43.4% of their value.