In one of the largest potential acquisitions of the year so far, Mars Inc. is reportedly in advanced talks about acquiring Kellanova (K) in a striking $30 billion deal. Kellanova has a market value of roughly $20 billion currently, which means the deal has an attractive implied premium attached. According to a Wall Street Journal report, talks between the two companies are in advanced stages and the deal could materialize soon if the parties agree to the terms.

However, the deal could face regulatory hurdles, as the U.S. Federal Trade Commission (FTC) has grown increasingly wary of large corporations’ anti-competitive practices. Both companies own major brands in the packaged foods sector and could draw the regulators’ ire. At the same time, Kellanova, which seems ripe for a takeover, could attract bids from other potential buyers.

About the Two Companies

Mars is one of America’s biggest candy manufacturers, with renowned brands such as M&M, Snickers, and Bounty under its umbrella. It is privately held by the Mars family and also operates a successful pet-care business (including the Pedigree brand) and a food and nutrition business.

Kellanova is a snacking company that was formed when the North American cereal business was spun off from parent Kellogg last year. WK Kellogg (KLG) kept the thriving cereals business while the snack brands and plant-based food units were regrouped under Kellanova. Notably, Kellanova houses popular brands such as Pringles, Cheez-It, Eggo Waffles, and MorningStar Farms.

Kellanova’s Improving Financials

Kellanova reported better-than-expected results for Q2 FY24 on August 1 and lifted the full-year outlook. The company’s adjusted earnings per share (EPS) of $1.03 (currency-neutral basis) rose 14.4% year over year and handily beat the consensus of $0.90.

Meanwhile, net sales of $3.19 billion fell 4.7% year over year, but exceeded the consensus of $3.15 billion. Kellanova noted that the declining sales were due to adverse currency movements and the divestiture of its operations in Russia last year.

Based on the stronger-than-anticipated first-half results, Kellanova raised its FY24 guidance. It now expects organic net sales to grow by at least 3.5% over FY23, backed by solid momentum in the company’s snacks brands and emerging markets.

Kellanova’s adjusted EPS is now projected in the range of $3.65 to $3.75, up from the prior outlook of $3.55 to $3.65.

Is Kellanova Stock a Buy?

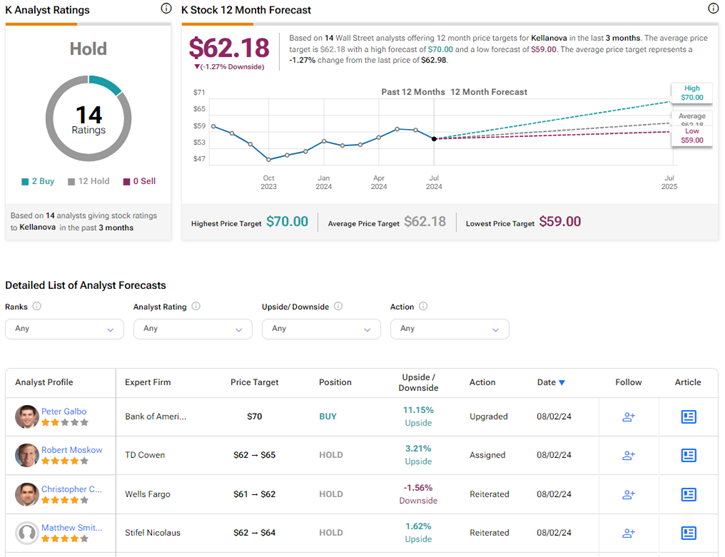

On TipRanks, K stock has a Hold consensus rating based on two Buys versus 12 Hold recommendations. The average Kellanova price target of $62.18 implies 1.3% downside potential from current levels. K shares have gained 14.8% so far this year.