Boston Scientific Corp. (NYSE:BSX) will acquire Silk Road Medical (NASDAQ:SILK) for around $1.16 billion. Shares of SILK, a medical device company, surged in trading following the news. Boston Scientific, a biomedical company, will acquire SILK at a purchase price of $27.50 per share and will complete the acquisition in the second half of this year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Rationale Behind the Silk Road Acquisition

Silk Road has developed a minimally invasive procedure called transcarotid artery revascularization (TCAR) to prevent stroke in patients with carotid artery disease. The management of Boston Scientific stated that the addition of this “clinically differentiated technology” to its vascular portfolio will “provide meaningful innovation for physicians.”

BSX expects that the impact of this acquisition will be “immaterial” to its adjusted earnings per share (EPS) in 2024 and 2025, meaning it will have a negligible or insignificant effect on the company’s adjusted EPS during those years. However, they expect it to be accretive to adjusted EPS afterward, which means the acquisition is anticipated to increase or improve the company’s adjusted EPS in the future.

Is BSX Stock a Good Buy?

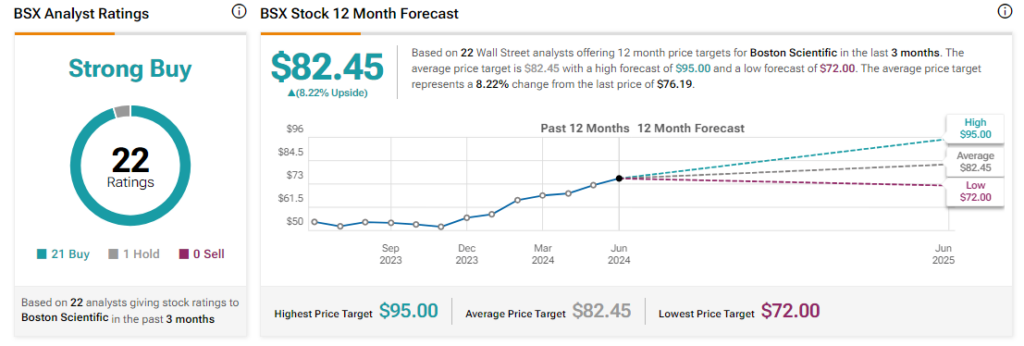

Analysts remain bullish about BSX stock, with a Strong Buy consensus rating based on 21 Buys and one Hold. Over the past year, BSX has surged by more than 35%, and the average BSX price target of $82.45 implies an upside potential of 8.2% from current levels.