U.S. President Joe Biden has decided to officially block the $14.1 billion proposed acquisition of U.S. Steel (X) by Japan’s Nippon Steel (JP:5401), according to the Washington Post, which cited two administration officials. Further, according to multiple media reports, Biden is expected to announce his decision on the acquisition as soon as Friday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Committee on Foreign Investment in the United States (CFIUS) had previously referred the decision to approve or block the deal to Biden. The President has time until January 7, 2025 to make a decision.

Opposition to the Nippon-U.S. Steel Deal

Nippon’s proposed acquisition of U.S. Steel, which was first announced in December 2023, was strongly opposed by the powerful United Steelworkers union and became one of the key political concerns during the U.S. presidential election.

Biden earlier expressed his opposition to the deal, saying that he wants U.S. Steel to be domestically owned and operated. In fact, President-elect Donald Trump also vowed to block the deal when he takes office later this month.

However, U.S. Steel has contended that the deal would bolster the country’s national and economic security and build “an alliance in steel to combat the competitive threat from China.” Meanwhile, Nippon Steel has been offering several concessions to seek the U.S. government’s approval. Most recently, Nippon offered the U.S. government veto power over any potential cuts to U.S. Steel’s production capacity.

Is U.S. Steel Stock a Buy, Sell, or Hold?

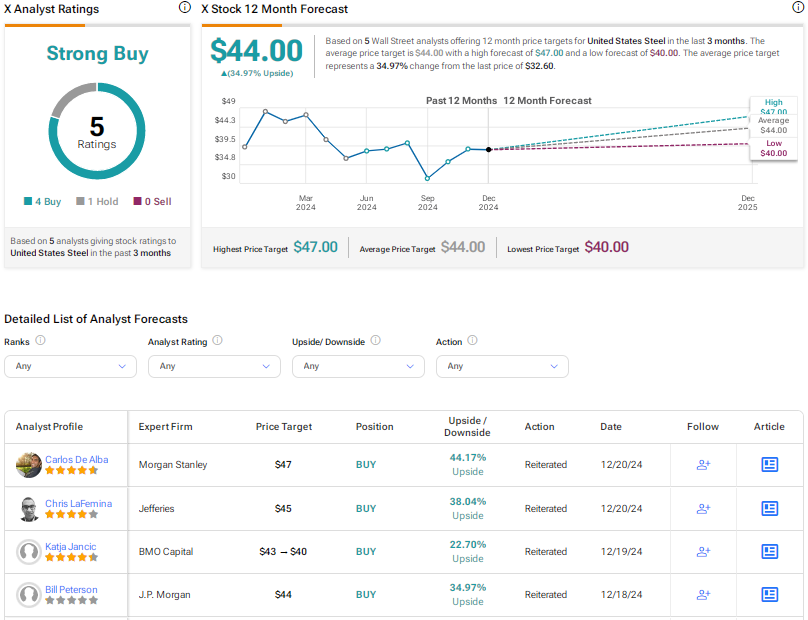

Despite the uncertainty about the approval of the deal, Wall Street has a Strong Buy consensus rating on U.S. Steel stock based on four Buys versus one Hold recommendation. The average X Stock price target of $44 implies about 35% upside potential from current levels. Shares have declined about 32% over the past year.