President Joe Biden plans to formally block the $14.1 billion sale of United States Steel (X) to Japan’s Nippon Steel (NPSCY) on grounds of national security, according to an exclusive Bloomberg report. The decision is expected once the Committee on Foreign Investment in the United States (CFIUS) refers the matter to him later this month, with a deadline set for December 22 or 23.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

CFIUS Review Suggests Concerns over National Security

The CFIUS review, ongoing for much of the year, has raised concerns about the potential risks of foreign ownership of a major U.S. steelmaker. The report stated that while the panel’s final recommendation remains unclear, any referral to the president indicates that at least one member of the Committee views the deal as a potential threat. If Biden blocks the merger, Nippon Steel and U.S. Steel may pursue litigation to challenge the decision.

U.S. Steel-Nippon Deal Has Been Politically Charged

This deal has become a hot political issue, particularly in Pennsylvania, home to U.S. Steel and Biden’s birthplace. The company has stated that the deal is essential to its survival and has warned of potential relocation of its headquarters and shuttering some of its operations if the deal collapses. Meanwhile, President Biden has long signaled opposition to the deal and has said that the company should be domestically owned. On the other hand, President-Elect Donald Trump has pledged to block the sale outright.

Nippon Steel Is Trying to Win Support for the Deal

Despite the political headwinds, Nippon Steel has worked for months to build support for the deal, announcing a $5,000 bonus for every U.S. Steel employee if the takeover proceeds to close. However, resistance remains strong, with the United Steelworkers union opposing the deal.

Following the Bloomberg news, Nippon Steel stated, “It is inappropriate that politics continue to outweigh true national security interests — especially with the indispensable alliance between the U.S. and Japan as the important foundation.”

Is U.S. Steel a Good Stock to Buy?

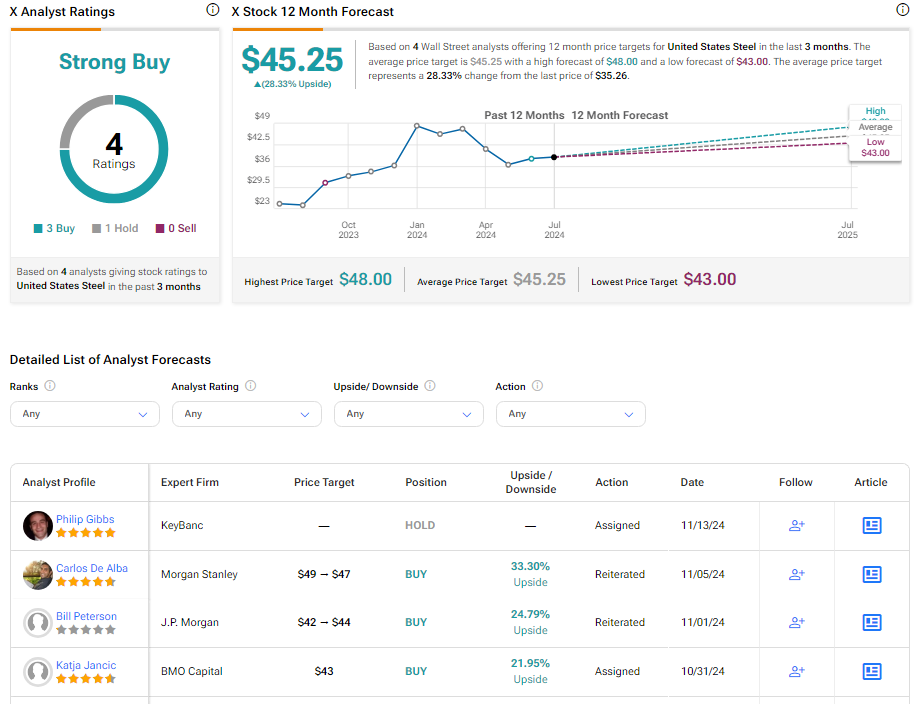

Analysts remain bullish about X stock, with a Strong Buy consensus rating based on three Buys and one Hold. Year-to-date, X has plunged by more than 25%, and the average X price target of $45.25 implies an upside potential of 28.3% from current levels.