Australian miner BHP Group Limited (AU:BHP) and Canada-based Lundin Mining (TSE:LUN) have partnered to acquire Canadian mining company Filo Corp. (TSE:FIL) for $3.25 billion. With this acquisition, both BHP and Lundin aim to strengthen their copper portfolios, to capitalize on the global shift towards cleaner energy. BHP shares lost 1.34% as of writing.

Both BHP and Lundin are multinational mining companies that produce diverse metals. Meanwhile, Filo is a Canadian exploration company primarily focused on developing its flagship project, Filo del Sol. This project is an open-pit copper, gold, and silver mine located in Atacama, Chile.

More on BHP-Lundin’s Filo Acquisition

For the acquisition, BHP and Lundin will establish a 50/50 joint venture to manage both Filo del Sol project and the Josemaria project near the Argentina-Chile border. Currently, Lundin owns 100% of the Josemaria project.

BHP and Lundin have proposed a price of C$33.0 per share for Filo, representing a 12.2% premium over Filo’s closing price on Monday. Filo’s shareholders can opt to receive cash, Lundin Mining shares, or a combination of both.

As part of the agreement, BHP is set to pay a total of $1.38 billion (C$1.91 billion) in cash, while Lundin will pay C$859 million in cash and about C$1.3 billion via its shares.

BHP’s Strategic Push into Copper

The partnership will establish a long-term collaboration between BHP and Lundin Mining to co-develop a promising copper district with significant potential. The demand for copper has surged globally due to the shift from fossil fuels to cleaner energy sources. Consequently, BHP has been working on enhancing its copper production to capitalize on the growing demand for the metal.

In April, BHP proposed a deal to buy the UK-based miner Anglo American PLC (GB:AAL). However, Anglo rejected three BHP offers, calling them undervalued.

Is BHP a Good Stock to Buy?

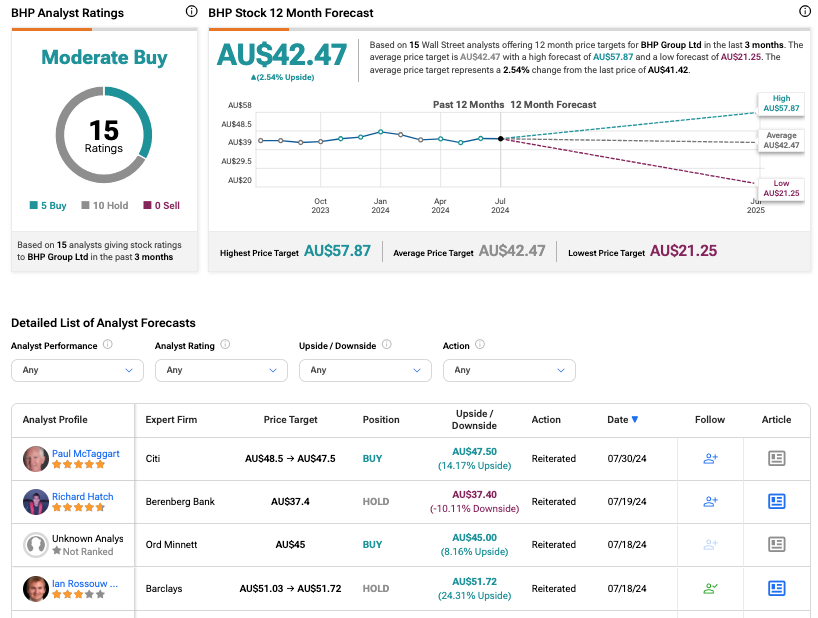

Today, Citi analyst Paul McTaggart reiterated a Buy rating on BHP stock, predicting an upside of 14%.

According to TipRanks’ consensus, BHP stock has been assigned a Moderate Buy rating, backed by 10 Hold and five Buy recommendations. The BHP share price target is AU$42.47, which is 2.5% above the current trading price.