Most of us do not think twice about going out to get some 7-Eleven, whether it is a Slurpee, a hot dog, or some other snack. But Canadian company Alimentation Couche-Tard (TSE:ATD) has a much bigger purchase in mind as the convenience store chain looks to get its hands on the entirety of 7-Eleven. Meanwhile, investors did not take it well, and shares slipped fractionally in Monday morning’s trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Couche-Tard recently put out a “…friendly, non-binding takeover offer” to 7-Eleven parent company Seven & I Holdings (JP:3382). The Japanese company, meanwhile, noted it had received the offer, which is valued at a hefty $31 billion. That may sound like a lot, but given that 7-Eleven brought in $5.5 billion last year, payback on such a deal would take a little over five years.

Couche-Tard, was about as polite as you could get with the whole thing, emphasizing that the deal was still early-stage, there was no certainty to it, it was designed to be “…a mutually agreeable transaction that benefits both companies,” and that no deal may ultimately come out of the process.

On a Roll

But this latest offer for 7-Eleven is not the last step, just the latest. Only days ago, Couche-Tard picked up all the GetGo locations formerly owned by Giant Eagle. The deal won’t actually close until next year, but reports suggest shoppers are concerned about how their rewards points programs will go.

Giant Eagle, meanwhile, assured customers that the myPerks loyalty program will continue at both Giant Eagle and GetGo locations, though they are also “…exploring opportunities to expand the program to unlock even more value and discounts for our customers.”

Is Couche-Tard a Good Stock to Buy?

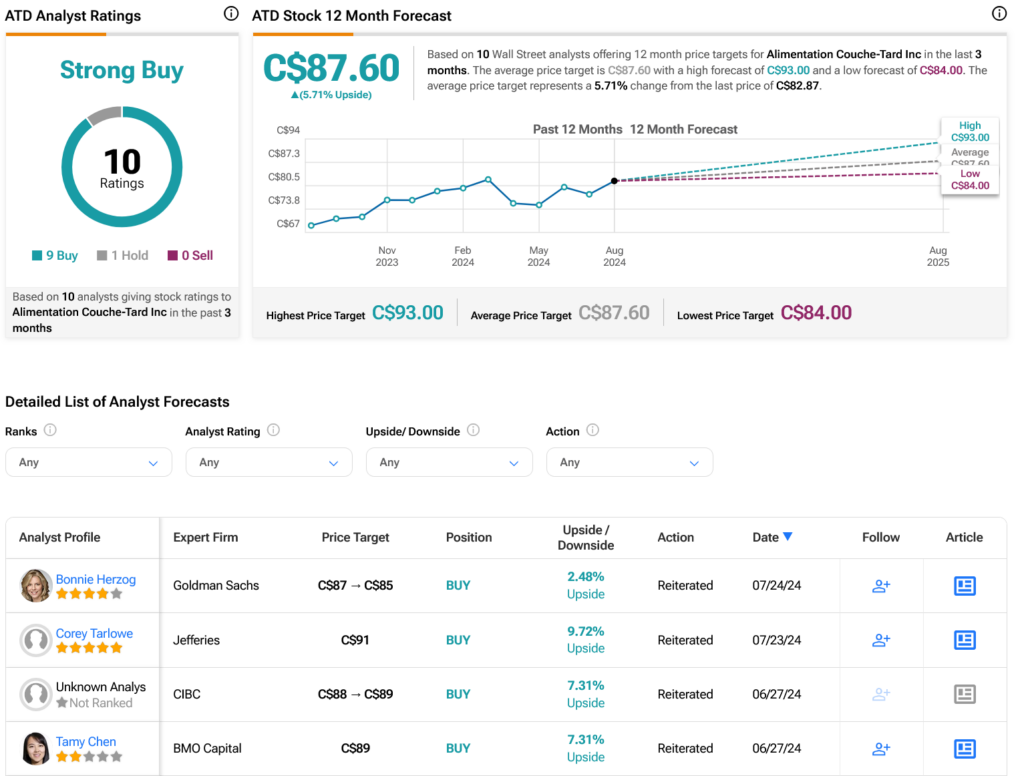

Turning to Wall Street, analysts have a Strong Buy consensus rating on TSE:ATD stock based on nine Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 21.23% rally in its share price over the past year, the average TSE:ATD price target of C$87.60 per share implies 5.71% upside potential.