Outdoor products provider YETI Holdings (NYSE:YETI) has agreed to acquire Mystery Ranch. The latter produces load-bearing backpacks, bags, and associated accessories.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

YETI products are geared towards outdoor adventurers and enthusiasts. Mystery Ranch’s focus on durability and performance for its products makes this strategic M & A move a potentially compelling play for YETI. While the integration of the companies’ teams and functions is expected to take place over the coming months, financial details of the deal remained under wraps.

Separately, YETI’s fourth-quarter results are coming up on February 15. Analysts expect the company to generate an EPS of $0.96 on revenue of $536.16 million for the quarter. In the comparable year-ago period, YETI’s EPS of $0.78 had lagged the Street’s expectations by a thin $0.01 margin. In Q3, robust demand for YETI’s Rambler and Yonder product lines was overshadowed by the impact of the soft cooler recalls the company initiated in Q1. Consequently, the company’s fourth-quarter performance will be keenly watched by investors.

Is YETI a Good Stock to Buy?

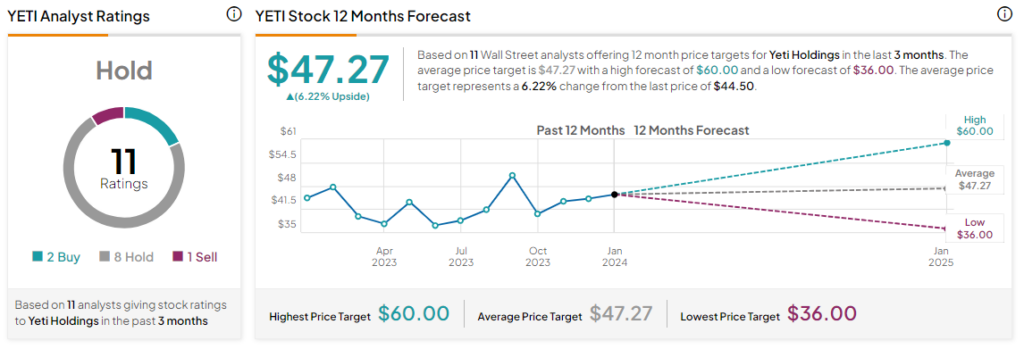

Overall, the Street has a Hold consensus rating on YETI, and the average YETI price target of $47.27 implies a 6.2% potential upside in the stock. That’s after a nearly 11% drop in the company’s share price over the past month.

Read full Disclosure