Ride-hailing company Lyft Inc. (LYFT) is planning to switch all of the vehicles deployed on its ride-hailing and rental car services to electric cars by 2030.

In collaboration with the Environmental Defense Fund, Lyft will be working with drivers to transition to electric vehicles (EVs). The transition has the potential to cut tens of millions of metric tons of planet-disrupting greenhouse gas emissions (GHG) and to reduce gasoline consumption by more than a billion gallons over the next decade, the company said.

The shift to 100% EVs for Lyft will mean transitioning all vehicles used on the Lyft platform over the next ten years to all-electric or other zero-emission technologies.

Lyft believes that the potential benefits to drivers are very significant, although the upfront cost of EVs today is higher than gas-powered cars. At the same time, EVs have lower fuel and maintenance costs that mean lower costs for drivers over the life of the vehicle. Lyft said that it sees this already with drivers renting cars through Express Drive, who currently save an average of $50-70 per week on fuel costs alone.

The ride-hailing company expects the savings to increase over time as the cost of EV batteries continues to come down. The company expects that by mid-decade, EVs will be more economical for rideshare drivers than gasoline cars.

“Now more than ever, we need to work together to create cleaner, healthier, and more equitable communities,” said Lyft’s co-founder and president John Zimmer. “Success breeds success, and if we do this right, it creates a path for others. If other rideshare and delivery companies, automakers and rental car companies make this shift, it can be the catalyst for transforming transportation as a whole.”

Rides on Lyft’s rideshare platform in May increased 26% versus April, although they were still down 70% year-over-year as stay-at-home orders tied to the coronavirus pandemic throttled demand. The stock declined 3.8% to $35.32 on Wednesday taking its year-to-date drop to 18%.

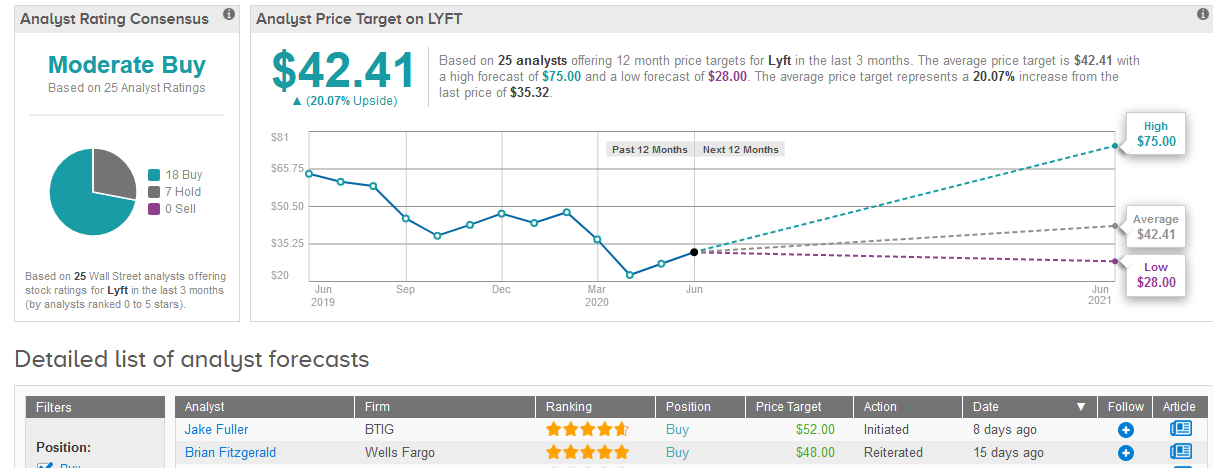

Five-star analyst Jake Fuller at BTIG this month initiated the stock with a Buy rating and a $52 price target, saying that the ridesharing industry should emerge from the lockdown on stronger footing.

Fuller believes that Lyft is “making hard choices” while accelerating the rationalization process, adding that its potential for underappreciated leverage in the model drives his positive view.

Overall, the Street has a cautiously optimistic outlook on Lyft. The Moderate Buy analyst consensus breaks down into 18 Buy ratings versus 7 Hold ratings. The $42.41 average price target implies 20% upside potential for the shares in the coming 12 months. (See Lyft stock analysis on TipRanks).

Related News:

Uber CEO Reveals Pickup In May Rides As Covid-19 Restrictions Ease

Lyft Rises 5% After-Hours On Strong May Performance

Uber In Partnership With MoneyGram For Driver Discount During Pandemic