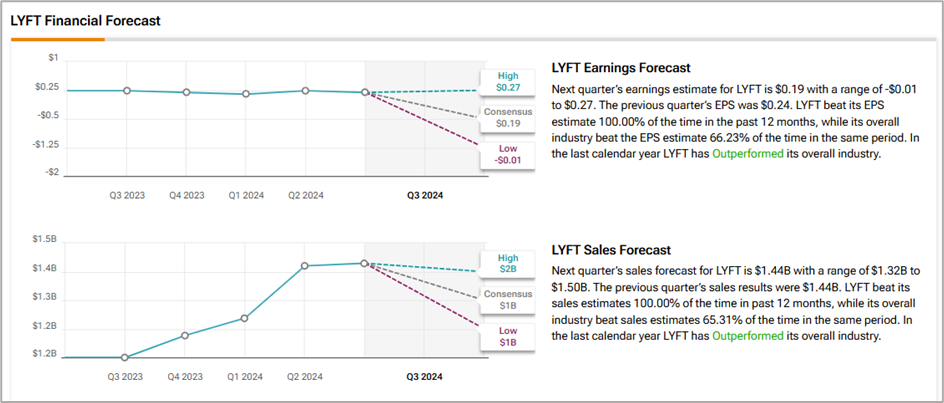

Ride-hailing service provider Lyft (LYFT) is set to release its Q3 FY24 results on November 6. The Street expects Lyft to report adjusted earnings per share (EPS) of $0.19, reflecting a 20.8% year-over-year decline. On the other hand, revenue is pegged at $1.44 billion, representing over a 24% jump compared to Q3 FY23, according to data from the TipRanks Forecast page.

Evercore ISI Analyst’s Preview of Lyft’s Earnings

Evercore ISI analyst Mark Mahaney gave a quick preview of Lyft’s upcoming Q3 results. The five-star analyst believes that Lyft could report “modest Beat & Bracket” earnings for Q3. Mahaney views the Street’s expectations for Q3 gross bookings, revenue, and EBITDA (earnings before interest, tax, depreciation, and amortization) as achievable.

Having said that, Mahaney referred to rival Uber’s (UBER) solid Q3 results and cited the ongoing challenges in the ride-sharing industry. Some of these include rising insurance costs, deceleration in mobility bookings in Q4, and the fact that autonomous vehicles (AV) are rapidly capturing a larger share of the market. Interestingly, Lyft has managed to exceed Wall Street expectations in seven of the eight past consecutive quarters.

Mahaney maintained a Hold rating and a $17 (25.2% upside potential) price target on Lyft shares ahead of the Q3 print. The analyst expects Lyft to rapidly ramp up its profitability amid the ongoing headwinds.

Insights from TipRanks’ Bulls Say, Bears Say Tool

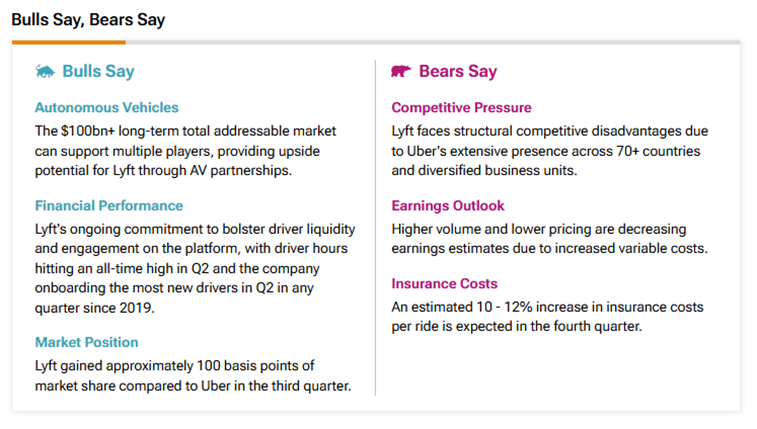

Analysts have varying views on Lyft’s performance. According to TipRanks’ Bulls Say, Bears Say tool, bulls are encouraged by Lyft’s increasing partnerships with AV companies, efforts to improve driver liquidity and engagement, and growing market share compared to Uber in Q3.

On the other hand, bears are concerned about competitive disadvantages owing to Uber’s widespread presence, declining earnings expectations, and rising insurance costs per ride.

Options Traders Anticipate a Major Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry as the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 14.43% move in either direction.

Is LYFT Stock a Buy?

Analysts prefer to remain on the sidelines on Lyft stock owing to their differing views. On TipRanks, LYFT stock has a Hold consensus rating based on six Buys versus 29 Hold recommendations. The average Lyft price target of $13.56 implies that shares are almost fully valued at current levels. Meanwhile, Lyft shares have declined 9.4% so far this year.

Questions or Comments about the article? Write to editor@tipranks.com