Shares of Lyft (LYFT) shot up 20% higher in after-hours trading after the ride-hailing company reported earnings for its third quarter of Fiscal Year 2024, which included solid guidance. GAAP earnings per share came in at -$0.03, which is not comparable to analysts’ consensus estimate of $0.19 per share on an adjusted basis. However, sales increased by 32% year-over-year, with revenue hitting $1.52 billion. This beat analysts’ expectations of $1.44 billion.

These results were driven by a 16% increase in Gross Bookings, which came in at $4.1 billion, and a 16% jump in rides to a record 217 million. Interestingly, the number of active riders increased by 9% to 24.4 million. This indicates that Lyft is doing a good job of retaining riders despite competing against Uber (UBER), which is the current market leader.

2024 Outlook

Looking forward, management has provided the following guidance for the rest of 2024:

- Q4 Gross Bookings between $4.28 billion and $4.35 billion

- Q4 adjusted EBITDA of $100 million to $105 million compared to expectations of $85.7 million

- Free cash flow to exceed $650 million for Fiscal Year 2024

As you can see, guidance was better than expected, which is what contributed to the stock’s after-hours move. It also helped that the firm signed a deal with Mobileye (MBLY) to increase the availability of robotaxis on Lyft’s platform.

Is Lyft Stock a Buy Now?

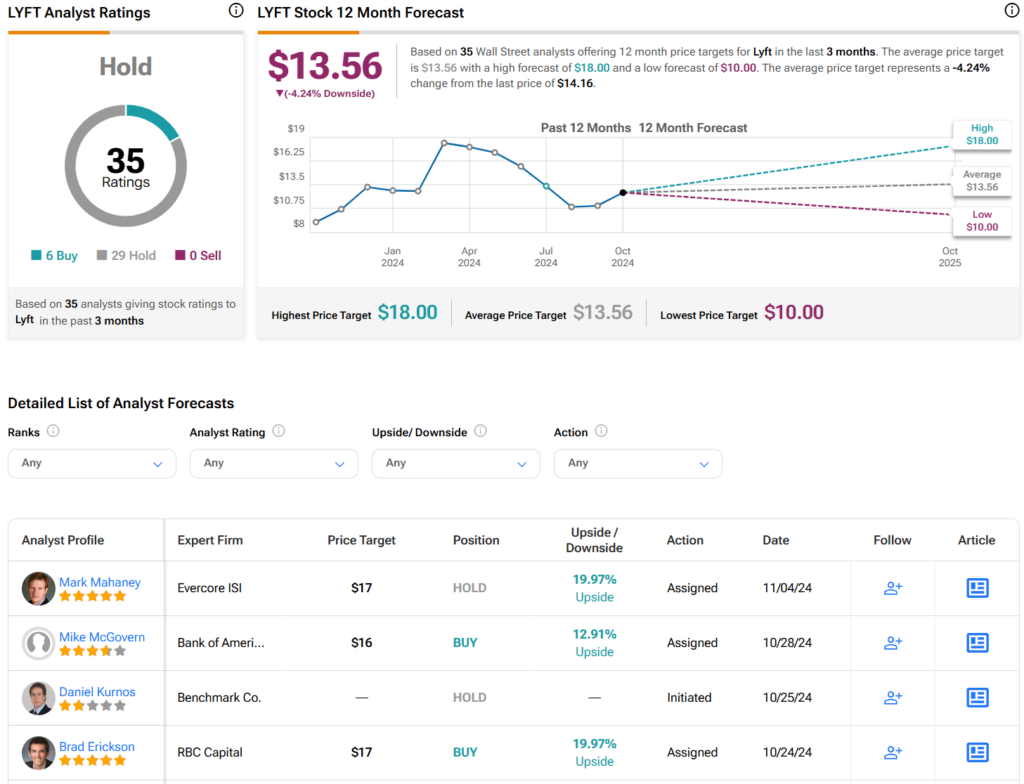

Turning to Wall Street, analysts have a Hold consensus rating on LYFT stock based on six Buys, 29 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 31% rally in its share price over the past year, the average LYFT price target of $13.56 per share implies 4.2% downside risk. However, it’s worth noting that estimates will likely change following today’s earnings report.