Lyft Inc. (LYFT) has just released its financial results for Q2 2024, and it’s fair to say they’ve knocked it out of the park. The ride-sharing giant saw a notable 41% revenue bump, hitting $1.4 billion, and even turned a profit with a net income of $5 million, quite the turnaround from the $114.3 million loss in Q2 2023.

Lyft’s Earnings Beat Expectations

Lyft came out with quarterly earnings of $0.24 per share, surpassing the analysts’ consensus estimate of $0.16 per share. This is a significant improvement compared to earnings of $0.15 per share a year ago. This earnings beat adds another feather to Lyft’s cap for Q2 2024, underscoring the company’s strong financial performance.

Lyft’s Financials

The numbers speak for themselves. Adjusted EBITDA surged to $102.9 million from $41 million in the previous year, indicating solid financial health and strong operational efficiency. CFO Erin Brewer echoed this sentiment: “Our platform is growing in a very healthy way as evidenced by the strength of our financial results, including strong cash flow generation and GAAP Net income.”

In addition, Lyft achieved a free cash flow of $256.4 million, a significant leap from a negative $112.2 million last year. This cash flow success is a testament to the company’s robust operational management and strategic focus.

Lyft CEO’s Insight on Success

“For over a year, you’ve heard us say that customer obsession drives profitable growth,” said CEO David Risher. “In Q2, we delivered, and drivers and riders are choosing Lyft in record numbers.” It seems this mantra is paying off, as the company saw Gross Bookings climb 17% year-over-year to $4 billion.

Lyft’s Record-Breaking Rider and Driver Activity

Lyft hit new highs with 23.7 million active riders, a 10% increase year-over-year, and an all-time record of 205 million rides. The company also reported an all-time high in driver hours and welcomed the most new drivers since 2019.

Social & Regional Events Drive Surge in Lyft Rides

Pride celebrations in June led to a 17% increase in rides. Moreover, in major cities like San Francisco, Denver, and Seattle, ride numbers spiked by about 50%. Additionally, Lyft saw a 23% increase in rides during spring graduation weekends in college towns, highlighting the platform’s pivotal role in significant life events.

Across the border, Canada has been a shining star for Lyft, with rides doubling in the second quarter compared to the previous year. Toronto has now grown to become Lyft’s 8th largest market, reflecting strong international growth.

Lyft’s Forward Guidance

For Q3 2024, Lyft expects Gross Bookings to be in the range of $4.0 billion to $4.1 billion, with an Adjusted EBITDA of $90 million to $95 million. Revenue growth is projected to maintain a low-to-mid-twenties percentage increase year-over-year. The company also anticipates a slight increase in gross margin and expects stock-based compensation to be around $120 million. Free cash flow margin is projected to stay steady, with a double-digit free cash flow margin for the rest of the year.

Is Lyft Stock a Buy Now?

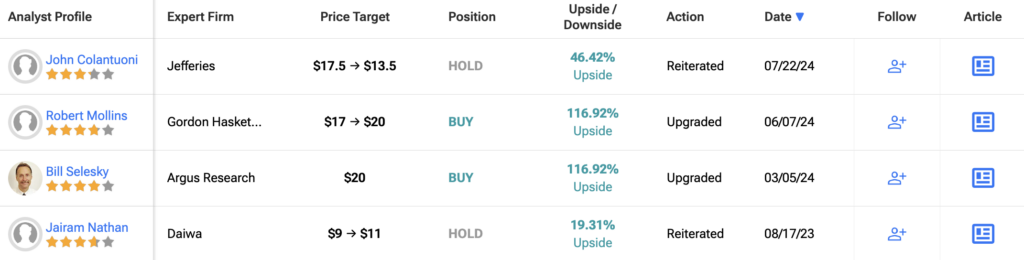

Analysts remain sidelined about LYFT stock, with a Hold consensus rating based on seven Buys and 23 Holds. Over the past year, LYFT has decreased by more than 20%, and the average LYFT price target of $18.82 implies an upside potential of a whopping 101% from current levels. These analyst ratings are likely to change following LYFT’s results today.