Ride-hailing company Lyft Inc. (LYFT) has reached a settlement agreement over allegations that some of its drivers denied rides to people using a collapsible wheelchair or folding walkers.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

As part of the settlement agreement, Lyft agreed to revise its wheelchair policies and pay damages ranging from $4,000 to $30,000 to four complainants with disabilities as well as a $40,000 civil penalty to the U.S. government.

The government alleged that Lyft violated the so-called Americans with Disabilities Act. The investigation was initiated after a complainant with disabilities filed at least 12 complaints with Lyft alleging that drivers in the Los Angeles area on multiple occasions repeatedly denied him a ride because he had a collapsible wheelchair. Another claimant alleged a Lyft driver denied her a ride because she had a walker.

The settlement agreement requires Lyft to modify its wheelchair policy to include that drivers are required to assist with the stowing of foldable or collapsible mobility devices used by individuals with disabilities, and provide $10 credits to riders who make “plausible complaints of discrimination” under the revised policies.

According to the settlement agreement, the San Francisco-based company denied that it is subject to the disabilities act, which specifies certain public transportation services. Lyft also denied discriminating against any individuals and asserted that the drivers on its platform are independent contractors.

“We’re proud that many people with disabilities who were previously underserved by existing transportation options now use Lyft as a reliable, safe, and affordable way to get around,” the company said in a statement.

Shares in Lyft have declined some 20% so far this year as stay-at-home orders tied to the coronavirus pandemic curtailed demand for its ride-sharing services. The stock fell 1.6% to $34.25 at the close on Monday.

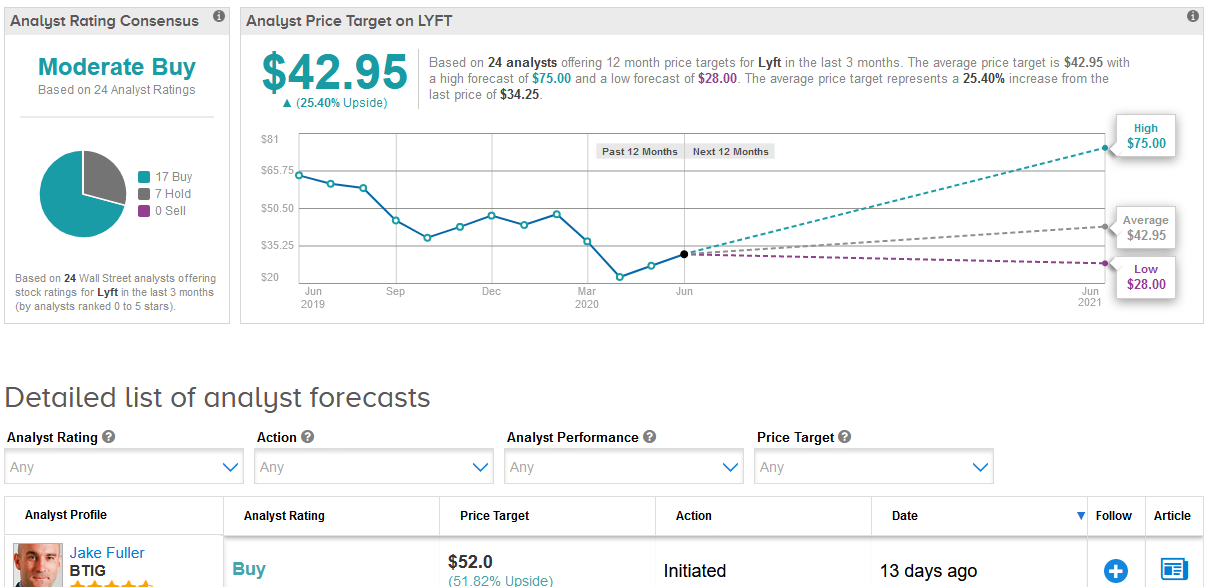

Earlier this month, BTIG analyst Jake Fuller initiated coverage of Lyft with a Buy rating and $52 price target (52% upside potential), saying that the ridesharing industry should emerge from the lockdown on stronger footing.

Fuller believes that Lyft is “making hard choices” while accelerating the rationalization process, adding that its potential for underappreciated leverage in the model drives his positive view.

Overall, Wall Street analysts have a cautiously optimistic outlook on Lyft with 17 recommending to buy the stock, while 7 say hold the stock, which adds up to a Moderate Buy consensus. The $42.95 average price target implies 25% upside potential in the shares in the coming 12 months. (See Lyft stock analysis on TipRanks).

Related News:

Lyft Plans To Switch To 100% Electric Cars By 2030

Uber CEO Reveals Pickup In May Rides As Covid-19 Restrictions Ease

Lyft Rises 5% After-Hours On Strong May Performance