Many investors will keenly look at how the retail sector performs from Thanksgiving Day through Cyber Monday. Indeed, retailers like Walmart (WMT), Costco (COST), Kohl’s (KSS), and Amazon (AMZN) are looking to take advantage of the holiday period, and Walmart might be this year’s holiday winner.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Usually, the fourth calendar quarter promises to be a seasonally strong quarter for the retail sector. According to the National Retail Federation (NRF), an estimated 182 million people will likely shop in-store or online during this holiday period. The NRF estimates that retail spending is expected to reach record levels during November and December and is likely to increase year-over-year between 3% and 4%, totaling $957.3 billion and $966.6 billion, respectively.

However, there are concerns that inflation (at 3.2% on an annual basis in October), higher interest rates, and the resumption of student loan payments have dampened shoppers’ moods.

Aspirational Luxury Retailers Could See Some Pullback

Many analysts believe that aspirational luxury retailers, like Nordstrom (JWN) and Tapestry (TPR), could see a pullback in retail spending during the holiday period. This is because the aspirational luxury shopper is not in the same income bracket as the traditional luxury shopper.

Indeed, Tapestry CEO Joanne Crevoiserat stated in a recent earnings call that “the aspirational consumer is under more pressure on a relative basis.”

Value Retailers Could be Winners

As shoppers grapple with inflation, many Wall Street analysts expect them to search for value deals, compare prices, and look for convenience. For top-rated TD Cowen analyst Oliver Chen, the retailer that could turn out to be a winner in this race is Walmart.

According to Chen, the retailing giant has done a “really great job” when it comes to competitive pricing and a seamless shopping experience. Despite a dip in WMT stock post-Q3 earnings, Chen sees it well-positioned for the upcoming holidays. WMT stock has slid by 1.4% over the past three months.

The analyst has a Buy rating and a price target of $188 on the stock, implying an upside potential of 21.5% at current levels.

Is Walmart Stock a Buy or Hold?

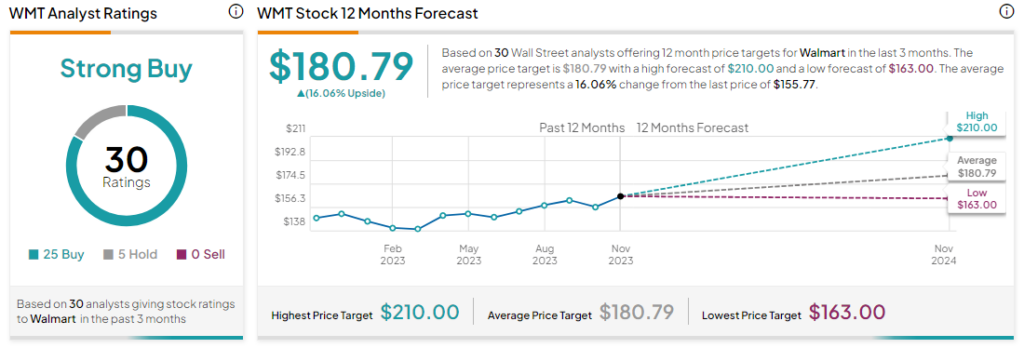

Analysts remain bullish about WMT stock, with a Strong Buy consensus rating based on 25 Buys and five Holds. The average WMT price target of $180.79 implies an upside potential of 16.1% at current levels.