Lululemon reported better-than-anticipated results for the third quarter of fiscal 2020 (ended Nov. 1) as the athletic apparel retailer benefited from strong e-commerce sales during the coronavirus pandemic. Shares fell 1.1% in the extended trading session on Thursday despite the 3Q beat.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Lululemon’s (LULU) 3Q revenue increased 22% year-over-year to $1.12 billion, exceeding the Street’s consensus of $1.02 billion. In addition, lower revenue from company-operated stores was more than offset by a 94% spike in the direct to consumer (or e-commerce) net revenue. Direct-to-consumer revenue accounted for 42.8% of overall sales in 3Q compared to 26.9% during the same period last year.

Furthermore, sales from other channels increased 42% due to the acquisition of at-home exercise equipment maker Mirror and a higher number of temporary locations, including seasonal stores, the company said. Meanwhile, 3Q adjusted EPS rose 21% to $1.16 and surpassed analysts’ estimates of $0.88.

The company stated that it was not providing a detailed outlook for fiscal 2020 due to the uncertainty associated with the COVID-19 pandemic. (See LULU stock analysis on TipRanks)

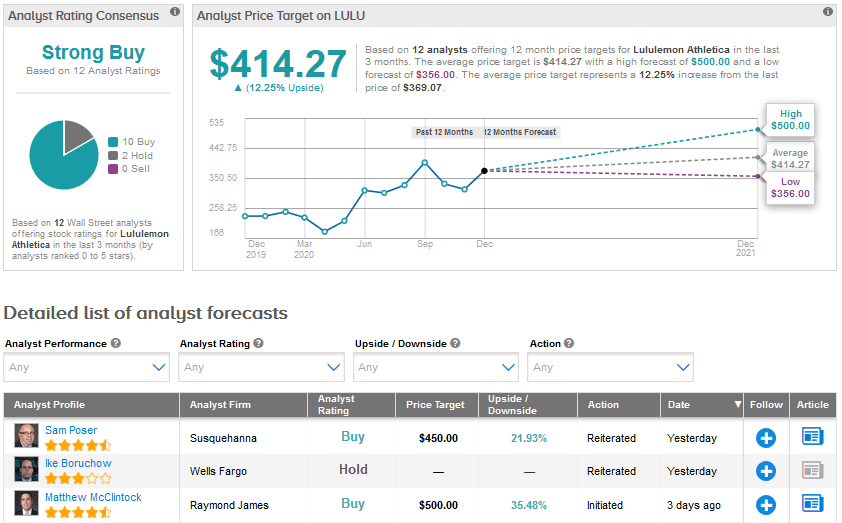

In reaction to the 3Q results, Susquehanna analyst Sam Poser increased his price target to $450 from $426 and reiterated a Buy rating. Poser commented in a note to investors, “The strong results highlight the evolution of PEP (Product, Engagement, & Process) at LULU, which will continue through the balance of FY20 and beyond. The PEP was evidenced by better than expected store productivity, despite pandemic-related capacity constraints, a 94% increase in e-commerce revenue, and a better than expected kickoff to the MIRROR era.”

“LULU continues to attract more customers to the brand, retain its existing customers, and take market share during the pandemic, leveraging digital engagement in the midst of capacity constraints in the stores. We are confident, as LULU still has a small global footprint, that LULU will successfully continue to grow its market share through its ever-improving Peppiness,” Poser said.

The rest of the Street has a Strong Buy analyst consensus backed by 10 Buys versus 2 Holds. The average price target stands at $414.27, indicating upside potential of 12.3% in the months ahead. Shares have already risen 59.5% so far this year.

Related News:

Campbell Soup’s Weak Guidance Overshadows 1Q Earnings Beat And Dividend Hike

RH Crushes 3Q Earnings Estimates; Wells Fargo Boosts PT

Walmart Pledges To Triple India-Manufactured Products By 2027; Street is Bullish